Market Surge: Is This Stock Rebound Sustainable or Temporary?

As I write on Friday, stocks are surging upwards.

Are we witnessing the start of a genuine bullish rebound, or are investors simply falling for a temporary rally before the market dips again?

To help discern the situation, let’s take a closer look at the underlying issues.

The current challenge for the market can be described as a “sentiment” problem.

The positive aspect is that, for now, it is not an “earnings” issue, which may limit the downside potential if any exists.

Let’s unpack this further.

Key Influencers on Stock Prices

- The earnings of the companies you’ve invested in

- The multiple that investors are prepared to pay for those earnings, which represents “investor sentiment”

In the short term, investor sentiment significantly impacts stock prices.

On any trading day, optimistic or pessimistic investor sentiment can drive stock values to astonishing highs or drastic lows based entirely on emotions such as greed and fear.

However, in the long term, stock prices always realign with their true master: earnings.

To illustrate this dynamic, refer to the chart below, which outlines the primary influences on stock performance over different time frames.

The left column displays the influences over the past year. Here, the “multiple” (representing “investor sentiment”) is highlighted in red, dominating at 46%. In contrast, revenue growth, the foundation for “earnings,” accounts for just 29% of stock price performance.

However, observe how this trend shifts as we examine more extended periods (the columns that follow).

Source: Morgan Stanley / The Future Investors

Over a decade, sentiment falls to just 5% in impacting stock performance.

Additionally, consider the chart below dating from 1945, which compares the S&P 500’s price to its trailing 12-month operating earnings.

The strong correlation between these two lines over the long term is noteworthy. This reinforces our argument that in the long run, earnings dictate stock prices.

You will also observe that the S&P’s price line (in green) fluctuates significantly around the smoother earnings line (in blue).

This illustrates how stock prices, driven by sentiment, can rise and fall dramatically, yet always converge back to the earnings line.

Source: Investment Strategy Group, Bloomberg, S&P Global

So, where do we currently stand in this earnings/sentiment interplay?

Recent Market Dynamics

The recent weeks’ market movements provoke further analysis…

Wall Street Analysts Revise S&P 500 Earnings and Sentiment Forecasts

Market Sentiment Drives Recent Stock Market Decline

The recent downturn in the stock market stems primarily from shifting investor sentiment. This change has prompted legendary investor Louis Navellier’s preferred economist, Ed Yardeni, to adjust his forecast for the S&P 500.

Yardeni has been recognized as one of Wall Street’s prominent bulls in recent years, a stance that has proven accurate. Although he continues to maintain a broadly bullish outlook, he has revised his forecast for the sentiment multiple while keeping 2025 earnings projections unchanged.

According to MarketWatch, Yardeni predicts that S&P 500 companies will achieve a combined earnings total of $285 per share. However, his anticipated valuation multiple is now adjusted to a range of 18 to 20, down from 18 to 22.

This adjustment decreases Yardeni’s best-case scenario for the S&P 500’s value to 6,400 from 7,000, and also lowers his year-end 2026 estimate to 7,200 from 8,000. His new “worst-case scenario” for the end of 2025 has been revised to 5,800.

Encouragingly, even with these adjustments, Yardeni’s updated worst-case scenario indicates the S&P could still rise nearly 4% from its current trading levels.

Yardeni acknowledges the risks to earnings, noting: “The latest batch of economic indicators released early this week supports our resilient economy view with subdued inflation.” He cautions, however, about potential stagflation due to unpredictable policies from the current administration.

Goldman Sachs Adjusts Earnings Forecast Amid Tariff Concerns

In a similar vein, Goldman Sachs has reduced its earnings forecast, adjusting it from $268 to $262 per share, although the broader Wall Street consensus sits at $270.

MarketWatch explains this change: “The revised earnings forecast is a response to Goldman’s economists lowering their GDP expectations following a projected 10-percentage-point increase in the tariff rate.” They note that each five-percentage-point increase in tariffs generally reduces S&P 500 earnings by 1% to 2%.

This latest forecast also considers the heightened uncertainty and tightening financial conditions in the current market.

Alongside the earnings downgrade, Goldman Sachs has slightly adjusted its sentiment multiple from 21.5 to 20.6. They assert that while uncertainty can briefly hinder equity valuations, a slower growth outlook suggests persistently lower valuations.

Nonetheless, Goldman shares a more optimistic view for stocks, predicting an increase to 6,200 for the S&P 500 by the end of 2025, representing an 11% rise despite the diminished earnings forecast.

Is the Sentiment Correction Beneficial for the Market?

Indeed, it appears so. Last year’s market sentiment reached overly optimistic extremes, a condition that often proves unsustainable. The current correction might serve as a recalibration.

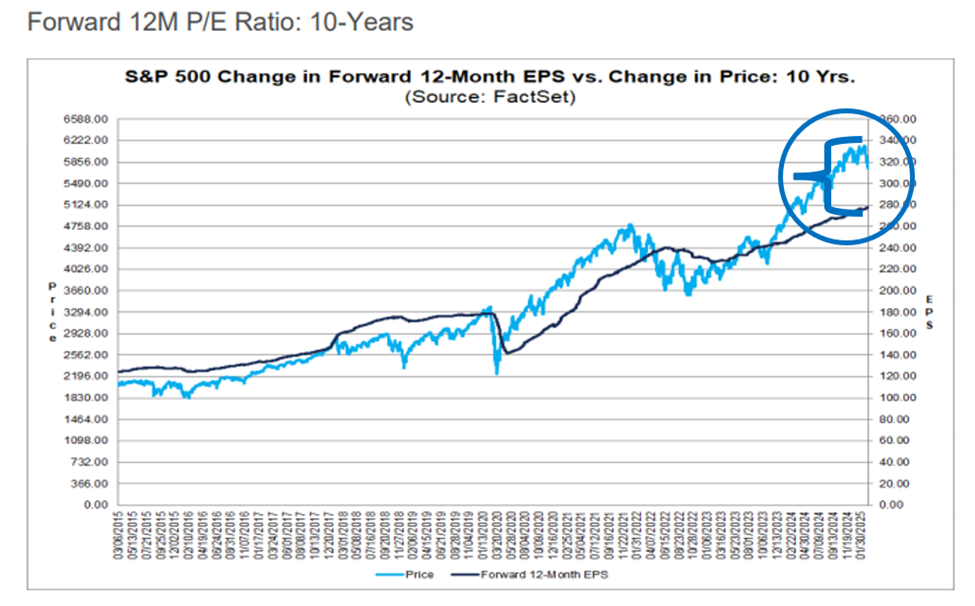

Examining the S&P 500’s price in light blue against the changes in its forward 12-month earnings estimates since 2015 shows a significant price increase, suggesting a disconnect between market sentiment and earnings projections

Source: FactSet

This ongoing adjustment has led to a more reasonable alignment between earnings and market price, which is generally favorable for long-term bulls.

Will Sentiment-Driven Pullback Persist or Escalate?

This remains a critical question. A sentiment-related pullback could present attractive buying opportunities, while a more severe downturn that factors in both sentiment and earnings would call for a cautious approach.

According to MarketWatch, historical data indicates that a 10% market decline without triggering a recession has resulted in gains on the S&P 500 about 90% of the time within six months, based on figures since 1980.

If sentiment and earnings decline together, however, the typical S&P 500 drawdown could peak at a 24% decline.

Looking ahead, analysts currently do not foresee an imminent earnings collapse. According to FactSet, which provides earnings analytics widely used by finance professionals:

“For Q2 2025 through Q4 2025, analysts project earnings growth rates of 9.7%, 12.1%, and 11.6% respectively.”

As we examine the broader economic landscape, the outlook remains cautiously optimistic.

Strong Earnings Growth Suggests Resilience Amid Economic Concerns

Recent reports indicate an earnings growth rate of 11.6% year-over-year.

Such growth could make it difficult for a deep, sustained bear market to take hold. Companies are demonstrating resilient performance despite various economic challenges.

Executives Discuss Tariffs, but Not Recessions

According to FactSet, while many executives have brought up tariffs during earnings calls, they have not emphasized the term “recession.” This lack of urgency is notable in the current economic landscape.

FactSet conducted a thorough analysis, searching for the term “recession” in conference call transcripts from S&P 500 companies between December 15 and March 6.

Only 13 of these companies mentioned “recession” during their fourth-quarter earnings calls.

This count is substantially lower than the five-year average of 80 and the ten-year average of 60 occurrences.

This quarter marks the lowest number of S&P 500 companies referencing “recession” since Q1 2018.

Understanding Recent GDP Projections

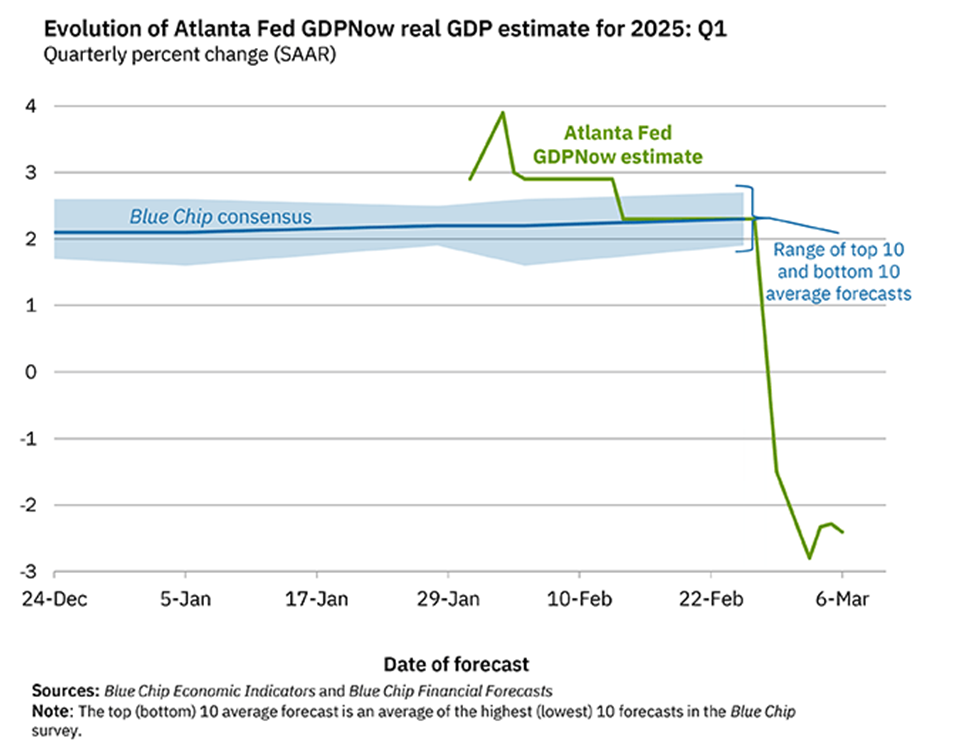

In light of recent economic data, the Atlanta Fed’s GDPNow Tool offers a current projection for GDP growth using a methodology akin to the U.S. Bureau of Economic Analysis. Presently, it indicates a stark contraction rate of -2.4%.

Source: Atlanta Fed

This forecast should be interpreted cautiously.

In a recent podcast on Breakthrough Stocks, Louis underscored that current data does not support a recession narrative.

He explained that trade surpluses have surged, indicating an influx of goods into the U.S. market, as demonstrated by a 34% spike in January. February’s trade figures may reflect more about the gross domestic product (GDP).

Moreover, the Institute of Supply Management (ISM) reported that manufacturing has shown growth for two consecutive months, following a prolonged contraction period of 26 months. Given that the U.S. economy is largely driven by the service sector, the data does not align with recession forecasts.

Insights on Earnings and Market Sentiment

Returning to the earnings theme, Louis offers valuable insights on market sentiment and stock performance. His approach emphasizes identifying companies with strong fundamentals, which often signals resilience even during market fluctuations.

In his recent remarks to subscribers, Louis reassured them that earnings are performing well.

Despite a sharp market correction, analysts have largely upheld earnings estimates, signaling confidence in underlying company performance.

Looking ahead, Louis highlighted a key development related to Nvidia Corp.’s (NVDA) upcoming “Quantum Day.” He expressed belief that this event could have significant implications for certain stocks in the quantum computing space.

Key Takeaways

Summarizing the key points, we can conclude the following:

- The current market drawdown appears to be more sentiment-driven, presenting a potential buying opportunity.

- Given the earnings forecasts, an earnings recession seems unlikely, which could help avert a severe bear market.

- However, the evolving landscape of tariff negotiations could alter this outlook depending on their impact and duration.

- Prioritizing the earnings strength of individual stocks can mitigate unnecessary anxiety and reactive decision-making in this market environment.

We will continue to monitor these developments closely.

Wishing you a pleasant evening,

Jeff Remsburg