Analysts Project Significant Upside For iShares Core Dividend Growth ETF

At ETF Channel, we evaluated the underlying holdings within the ETFs we monitor by comparing the trading price of each holding to the average analyst’s 12-month forward target price. This analysis yielded a weighted average implied analyst target price for the iShares Core Dividend Growth ETF (Symbol: DGRO) of $70.44 per unit.

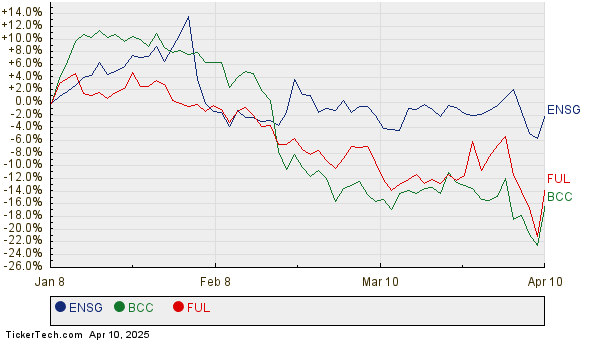

Currently, DGRO is trading at approximately $58.91 per unit, implying a potential upside of 19.58% based on the average analyst targets for its underlying holdings. Three notable companies contributing to this upside are Ensign Group Inc (Symbol: ENSG), Boise Cascade Co. (Symbol: BCC), and Fuller Company (Symbol: FUL). Recently, ENSG traded at $129.29 per share, yet analysts set an average target of $166.00 per share, indicating a potential upside of 28.39%. Meanwhile, BCC holds a recent price of $98.42, with a target of $126.33, suggesting an upside of 28.37%. Additionally, analysts expect FUL to reach a target price of $64.80 per share, representing a 20.63% increase from its recent price of $53.72. Below is a twelve-month price history chart comparing the stock performances of ENSG, BCC, and FUL:

Here’s a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend Growth ETF | DGRO | $58.91 | $70.44 | 19.58% |

| Ensign Group Inc | ENSG | $129.29 | $166.00 | 28.39% |

| Boise Cascade Co. | BCC | $98.42 | $126.33 | 28.37% |

| Fuller Company | FUL | $53.72 | $64.80 | 20.63% |

Do analysts have valid grounds for these targets, or are they being too optimistic regarding where these stocks will trade in the next twelve months? It’s critical to assess whether analysts’ target prices are justified based on the latest company and industry developments. High price targets relative to a stock’s trading price can showcase a favorable outlook but may also precede downgrades if past data overshadows recent trends. Investors should conduct thorough research to navigate these complexities.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Funds Holding DHHC

• Institutional Holders of DTD

• EDS Historical Stock Prices

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.