Advanced Micro Devices (NASDAQ: AMD) reported its Q1 2024 earnings on April 30, 2024, revealing non-GAAP earnings per share of $0.62, exceeding estimates by $0.01. Revenue increased by 2% year-over-year to $5.5 billion, beating forecasts by roughly $20 million. Despite this, AMD’s stock has seen a 16% decline over the last three months, as excitement fades compared to competitor Nvidia, whose revenue surged by 262% in the same quarter.

AMD’s gaming and embedded divisions reported significant revenue decreases of 48% and 46%, respectively, while its data center and client segments saw growth exceeding 80%. The company aims to remain competitive by releasing new AI chips, including the MI325X accelerator set for Q4 2024.

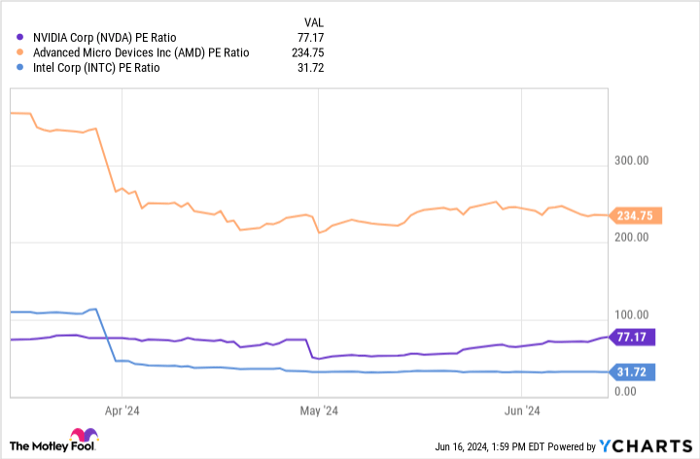

Over the past decade, AMD’s shares have risen more than 3,600%. However, a 37% drop in free cash flow in the last 12 months raises concerns about its near-term investment potential. Analysts have pointed out that compared to Nvidia and Intel, AMD’s valuation metrics, such as its P/E ratio, suggest that it may be overpriced relative to its growth prospects.