Are High-Yield Dividend Stocks in the S&P 500 Worth the Risk?

If you’re seeking investment income, the S&P 500‘s (SNPINDEX: ^GSPC) top-yielding dividend stocks may seem like an obvious choice. These companies are some of the largest and most established in the market, providing more income than many alternatives.

However, this straightforward strategy carries significant risks. The high dividends may not be sustainable, particularly if the companies behind them are struggling financially.

A Closer Look at the Highest-Yielding Stocks

As of now, the S&P 500’s highest-yielding stocks include carmaker Ford Motor Company (NYSE: F), tobacco producer Altria (NYSE: MO), and pharmacy chain Walgreens Boots Alliance (NASDAQ: WBA). Their forward dividend yields are currently at 5.6%, 8.2%, and 9.6%, respectively.

While these yields are impressive when compared to the S&P 500’s average yield of only 1.3%, there’s more to consider.

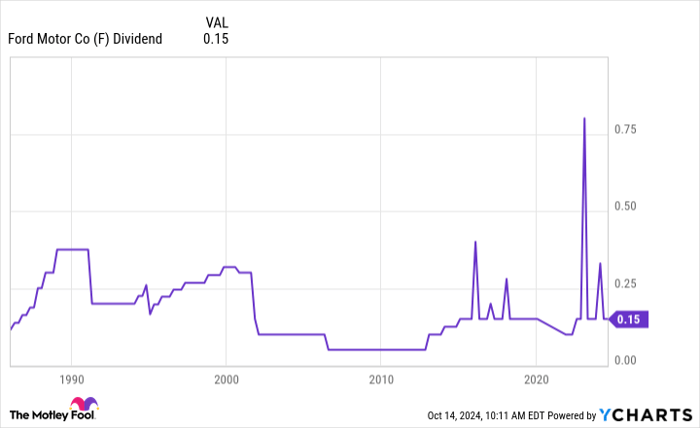

Take Ford, for example. Although it boasts a 5.6% dividend yield, its payout history is inconsistent. Excluding special dividends, the company has not increased its dividend in years. Shareholders have watched the real value of their dividends decline over time, largely due to inflation.

Data by YCharts.

This lack of growth reflects ongoing challenges in the auto industry. Ford is investing heavily in electric vehicles, but this has added to its financial strain.

Next, we have Altria, known for its reliable dividends and status as a Dividend King with over 50 years of annual increases. However, the tobacco giant faces a significant headwind: its core cigarette business is experiencing a long-term decline.

With fewer smokers each year, Altria has struggled to find success in new areas like vaping and smokeless tobacco. Past investments in brands like Juul and IQOS have not yielded the expected results. As a result, the cigarette business remains critical to Altria’s revenue. If alternatives don’t gain traction soon, there may come a time when the company can’t maintain its hefty dividend.

While that potential crisis may be far off, it’s important to recognize that Altria’s current cash flow could diminish, which may also impact stock value in the long run.

Now, regarding Walgreens: the company is facing significant challenges. It has made headlines for cutting its quarterly dividend from $0.48 to $0.25 earlier this year to preserve cash. This reduction is indicative of serious financial strain, as Walgreens is dealing with decreasing insurance reimbursement rates along with specific issues related to past decisions, such as the purchase of Boots.

Moreover, Walgreens is not in a stable financial position, shown by its $42.5 billion in long-term debt and announced store closures. With the company barely breaking even as it attempts to restructure, prospects for recovery look bleak.

Should You Invest Now?

When considering high-yield dividends, analyzing the full financial picture of a company is essential. Typically, higher yields come with higher risks. Investors often accept lower yields in exchange for stability; conversely, they demand higher yields for the increased risk of potential dividend cuts.

For most investors, Walgreens and Ford present risks that may not be worth taking. Altria provides some dividend appeal, but its future in that area is uncertain.

This suggests that if consistent dividends and potential growth are your goals, it may be wise to look elsewhere. Stocks with slightly lower yields can offer greater reliability, along with better chances for long-term price appreciation.

Is Altria Group a Good Buy Right Now?

Before you consider purchasing Altria Group stock, keep this in mind:

The Motley Fool Stock Advisor team has recently identified what they consider to be the 10 best stocks for investment at this time—and Altria wasn’t included. Those selections may deliver substantial returns in the future.

For instance, when Nvidia appeared on this list on April 15, 2005, a $1,000 investment at that time would be worth $831,707 today!*

Stock Advisor offers an easy-to-follow roadmap for successful investing, which includes tips on portfolio building and regular updates from analysts, along with two new stock picks every month. The Stock Advisor service has more than quadrupled the S&P 500’s returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.