Nvidia and Alphabet Compete in AI Chip Market

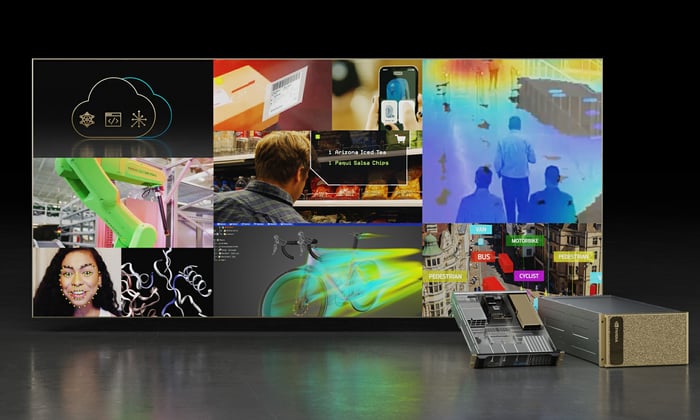

Nvidia (NASDAQ: NVDA) has secured approximately 92% of the market share in the data center GPU chip space as of early 2023. The company announced it has booked $500 billion in orders for its Blackwell chips, with $150 billion already delivered. This growth underscores Nvidia’s strong position in artificial intelligence (AI) data center technologies.

Meanwhile, Alphabet (NASDAQ: GOOGL) has developed its own custom-built Tensor Processing Units (TPUs) for AI workloads, successfully training its Gemini model. Although Alphabet may not challenge Nvidia’s market leadership directly, its TPUs offer potential cost savings and an opportunity to sell to other companies, enhancing Alphabet’s AI ecosystem.

Experts suggest that while Nvidia presents maximum upside potential due to its dominant market presence, Alphabet may represent a more stable investment due to its diversified business operations, including cloud computing and advertising. Both stocks maintain attractive valuations as they navigate the evolving AI landscape leading into 2026.