Dissecting Wall Street Recommendations: Netflix’s Stock Potential

Investors frequently rely on Wall Street analysts’ recommendations when deciding whether to Buy, Sell, or Hold a stock. But how much influence do these ratings really have on stock prices? Let’s delve into what brokerage analysts are saying about Netflix (NFLX).

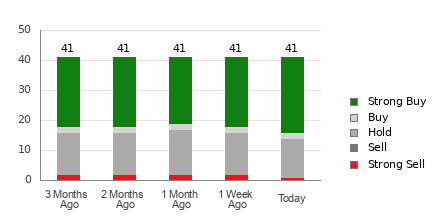

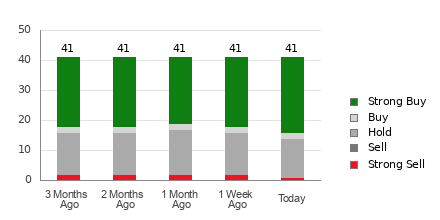

Netflix currently boasts an average brokerage recommendation (ABR) of 1.67, based on a scale from 1 to 5 (Strong Buy to Strong Sell). This average stems from the recommendations of 41 brokerage firms and suggests a position hovering between Strong Buy and Buy.

Breaking down the recommendations, 26 are categorized as Strong Buy, while two are classified as Buy. This means Strong Buy recommendations make up 63.4% of all suggestions, while Buy accounts for 4.9%.

Understanding NFLX Brokerage Recommendations

While this ABR indicates that analysts favor buying Netflix, it’s essential to take these ratings with caution. Research shows that brokerage recommendations often fail to predict stocks that will see significant price increases.

Why is that? Brokerage analysts may show a bias due to their firms’ interests in the stocks they cover, leading to excessive positive ratings. For every “Strong Sell,” there are typically five “Strong Buy” ratings issued by these firms.

This discrepancy suggests that brokerage recommendations might not align with retail investors’ interests and may not accurately forecast a stock’s future pricing. Therefore, employ these recommendations alongside your independent analysis or a proven predictive tool.

One such tool is the Zacks Rank, which has a reliable track record to support investment decisions. The Zacks Rank categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell) based on extensive data analysis. Using the Zacks Rank in combination with the ABR can enhance the accuracy of investment choices.

Distinguishing Zacks Rank from ABR

Despite both being rated on a scale from 1 to 5, Zacks Rank and ABR measure different aspects of stock performance.

The ABR relies solely on brokerage recommendations and is generally presented with decimal values (e.g., 1.28). Conversely, the Zacks Rank is a quantitative model focusing on earnings estimate revisions, using whole numbers and serving as a more reliable indicator.

Historically, analysts’ favorable ratings are often more optimistic than their research supports due to firm interests, leading to misleading guidance for investors.

A unique feature of the Zacks Rank is its use of earnings estimate revisions, which are strongly correlated with short-term stock performance. This model ensures that the rankings remain balanced across sectors where analysts provide updated earnings forecasts.

Moreover, the Zacks Rank offers timely insights, quickly reflecting analysts’ revisions, while the ABR may lag behind in updating its recommendations.

Is NFLX a Good Investment?

Considering the latest trend in earnings estimates, the Zacks Consensus Estimate for Netflix has risen by 2.3% in the last month, reaching $24.17 per share.

This widespread optimism about Netflix’s earnings suggests that analyst confidence could drive the stock higher in the coming months.

The increase in the consensus estimate, combined with additional favorable indicators, has given Netflix a Zacks Rank #2 (Buy). You can find the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Therefore, while the Buy-equivalent ABR for Netflix is worthwhile, consider it a supplementary tool alongside a thorough analysis.

Zacks Highlights Top Semiconductor Stock

This stock is only 1/9,000th the size of NVIDIA, which has increased over +800% since our recommendation. While NVIDIA remains robust, this new semiconductor stock shows greater growth potential.

With strong earnings growth and a rapidly expanding customer base, it is well-positioned to meet soaring demands in Artificial Intelligence, Machine Learning, and the Internet of Things. Experts project that the global semiconductor market will explode from $452 billion in 2021 to $803 billion by 2028.

Explore this stock opportunity now for free.

Stay updated with the latest recommendations from Zacks Investment Research by downloading our report on the 7 Best Stocks for the Next 30 Days.

Netflix, Inc. (NFLX): Get the Free Stock Analysis Report.

For the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.