Tractor Supply Faces Recent Challenges Amid Competitive Market Landscape

Brentwood, Tennessee-based Tractor Supply Company (TSCO) stands as the country’s leading retailer focused on rural communities and outdoor enthusiasts. With a market capitalization of $28.1 billion, the company operates a wide network of stores that offer a diverse range of products, including livestock feed, farm equipment, pet care essentials, and home improvement supplies. In addition to retail, Tractor Supply has fostered a loyal customer base through its Neighbor’s Club loyalty program and a strong commitment to community initiatives.

Classified as a “large-cap stock,” Tractor Supply is a notable player in the market, as companies valued at around $10 billion or more fall into this category. Its extensive product assortment and deep understanding of rural consumer needs have reinforced its status as a primary destination for those living and working in the countryside.

Active Investor: FREE newsletter goes behind the headlines on the hottest stocks to uncover new trade ideas

Currently, TSCO shares are trading 14.2% below their 52-week high of $61.53, reached on October 15. Over the past three months, the stock has experienced a slight decline, outperforming the Consumer Discretionary Select Sector SPDR Fund (XLY), which decreased by 13.6% in the same period.

Despite a 3.6% drop over the last six months, TSCO has achieved a 3% gain over the past year. In contrast, XLY has shown greater stability, with only a minor decline over six months and a 9.2% rise year-over-year.

As TSCO continues trading below both its 50-day and 200-day moving averages since the start of the month, this trend suggests bearish momentum.

On January 30, Tractor Supply shares fell by 5% following its Q4 earnings announcement. The company reported net sales of $3.77 billion, marking a 3.1% year-over-year increase. Comparable store sales saw a modest increase of 0.6%, though earnings per share dipped to $0.44 from $0.46 in the same quarter last year. During this quarter, the company opened 26 new Tractor Supply stores and four Petsense by Tractor Supply stores.

Looking ahead to fiscal 2025, Tractor Supply intends to open approximately 90 new Tractor Supply stores and 10 new Petsense by Tractor Supply stores. The company anticipates earnings per share between $2.10 and $2.22, with projected revenue growth of 5% to 7%.

In contrast, competitor O’Reilly Automotive, Inc. (ORLY) has outperformed TSCO. ORLY shares have risen by 20.1% over the past six months and 18.1% over the last 52 weeks.

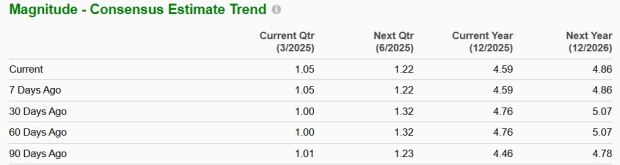

Despite recent challenges, analysts maintain a moderately bullish outlook for TSCO. The stock carries a consensus rating of “Moderate Buy” from 31 analysts. The mean price target is $59.23, indicating a potential upside of 12.2% from current market prices.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.