UPS Offers Solid Dividend Yield Amid Market Challenges

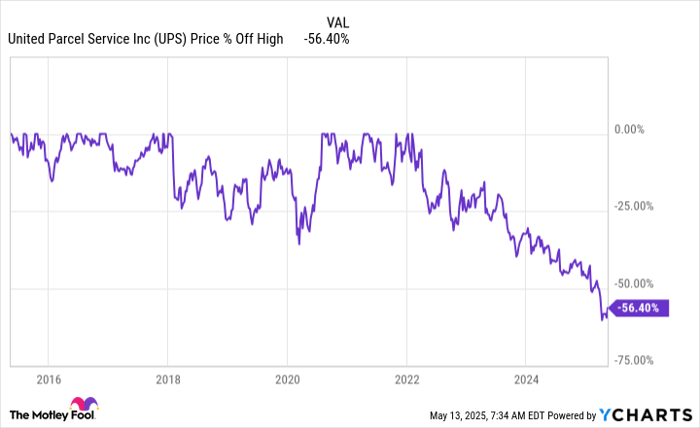

At its current share price, United Parcel Service‘s (NYSE: UPS) dividend provides a substantial 6.4% yield. Backed by 16 consecutive annual dividend increases, this yield outshines the S&P 500 (SNPINDEX: ^GSPC) index’s mere 1.3%. This compelling dividend may prompt income-seeking investors to closely evaluate UPS. However, with international trade facing potential tariff-driven disruptions, is investing in UPS still worthwhile?

The Impact of the Pandemic on UPS

Business conditions can change rapidly on Wall Street, as seen with UPS during the pandemic. Starting in 2020, the coronavirus crisis led to a surge in UPS’s Stock prices. The belief was that COVID-19 would result in sustained online shopping, thereby boosting delivery firms like UPS.

However, thanks to swift vaccine development, the pandemic transitioned from a public health crisis to a manageable endemic situation. As restrictions eased, consumer behavior shifted back toward in-person activities, leading to a decline in positive sentiment about UPS’s future. The stock has since dropped more than 50% from its early 2022 peak.

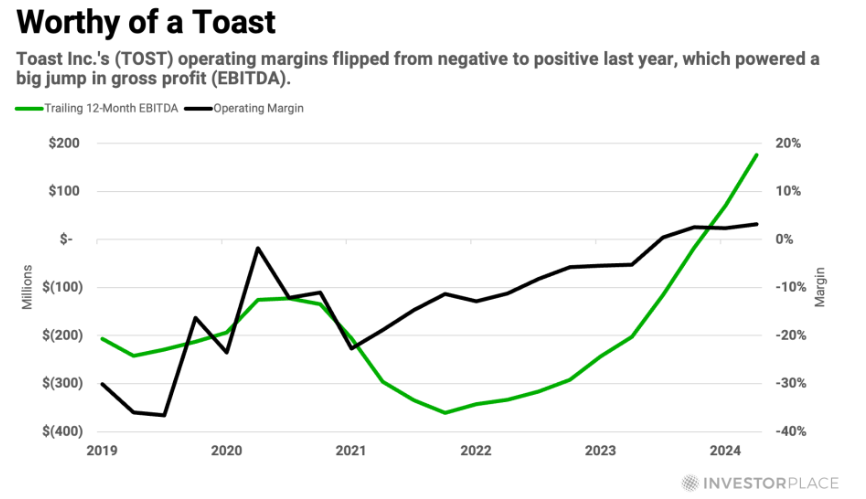

In response, UPS has been undergoing a significant business transformation, including facility closures and modernization efforts, as well as negotiations with its labor union. Aiming to enhance profitability, the company has begun to see early signs of success, with its profit margin stabilizing post-2024.

Image source: Getty Images.

Challenges from Tariffs and Strategic Shifts

As UPS’s profit margins began to recover, management made the bold decision to significantly reduce its business with its largest customer, Amazon.com. This choice arose from the understanding that the partnership was becoming less profitable, especially as Amazon expanded its own delivery network.

While investors reacted negatively to this strategy, it was deemed a necessary step for long-term viability. Yet, shifting tariff policies under the current administration have introduced uncertainties in global trade, contributing to a nearly 20% drop in UPS shares in 2025.

The recent sell-off may seem justified if one believes global trade will struggle to recover from previous disruptions. However, given today’s interconnected economy, such fears might be exaggerated. Current trade discussions between the U.S. and China could indicate that rational solutions are possible, suggesting that investors may be overly pessimistic about UPS’s long-term prospects.

UPS’s Resilient Position

UPS faces significant tasks ahead as it adjusts to decreased package volumes due to its reduction in Amazon-related deliveries. Close monitoring of its execution during this transition will be vital.

Despite these challenges, seasoned dividend investors may recognize that UPS is stabilizing its core operations. While its bottom line continues to feel the effects of the business overhaul, early indicators show that first-quarter 2025 revenues and operating profits are up year over year. This performance suggests that UPS is handling its difficulties well, making it an intriguing investment opportunity for those interested in turnaround stories.

Is Now the Right Time to Invest in UPS?

Before considering an investment in Stock of United Parcel Service, keep the following in mind:

The analyst team has identified their top 10 stocks for investment at this moment, with United Parcel Service not making the cut. The selected stocks could offer substantial returns in the coming years.

It is essential to note the historical successes of earlier recommendations; for instance, an investment in Netflix in 2004 would have grown significantly over time.

Please evaluate these insights thoroughly as you consider adding UPS to your portfolio.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.