Vulcan Materials Co: Strong Year-to-Date Performance Amidst Mixed Earnings

Vulcan Materials Company (VMC), based in Birmingham, Alabama, boasts a market cap of $36.4 billion. The firm stands out as a major producer of construction aggregates and materials, providing essential products like crushed stone, sand, and gravel. These materials play a crucial role in various projects, from infrastructure to residential buildings across the United States.

Large-Cap Stock With a Solid Market Presence

Being valued at over $10 billion, Vulcan qualifies as a “large-cap stock.” The company’s strong performance and reputation in the construction materials industry highlight its leadership role. Vulcan’s focus on quality, sustainability, and innovation reinforces its significance in meeting the construction sector’s needs.

Stock Performance Overview

Currently, Vulcan’s shares are trading 7.6% below their 52-week high of $298.31, reached on November 6. In the last three months, the stock has increased by 16.1%, showing resilience compared to the Materials Select Sector SPDR Fund’s (XLB) decline of 3.7% in the same timeframe.

Over the past year, VMC stock has risen by 21.5% and shows a 23.3% increase year-to-date, greatly outpacing the XLB’s annual gain of just 6.2% and 4.3% so far in 2024.

Current Market Momentum

Vulcan has consistently traded above its 50-day and 200-day moving averages since October, reflecting a positive market trend.

Q3 Earnings Report Results

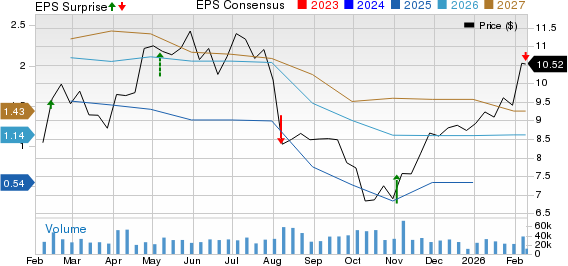

On October 30, Vulcan Materials’ shares jumped by over 6% following its Q3 earnings release. The company reported revenue of $2 billion, aligning with forecasts yet down 8.3% from last year. Adjusted earnings per share (EPS) of $2.22 fell short of analyst expectations by 4.1%. Additionally, EBITDA reached $581 million, slightly lower than the anticipated $584.2 million, leading to a revision of the full-year EBITDA guidance down to $2 billion from the previous estimate of $2.03 billion. Despite this, the free cash flow margin impressively surged to 24.9%, compared to 10.8% in the same quarter last year.

In contrast, Vulcan’s competitor, Martin Marietta Materials, Inc. (MLM), has underperformed, showing a 12.9% rise over the past year and a 10.4% increase year-to-date.

Analyst Outlook

Analysts maintain a cautiously optimistic view on Vulcan Materials, reflected in the stock’s “Moderate Buy” rating from 19 covering analysts. The current mean price target stands at $301.91, suggesting a potential upside of 9.5% from its current trading level.

On the date of publication, Rashmi Kumari did not hold (either directly or indirectly) any positions in the securities mentioned in this article. All information and data provided are for informational purposes only. For more details, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.