The valuation of Even Construtora e Incorporadora (BOVESPA:EVEN3) is on a meteoric rise, with the average one-year price target hitting 8.47 / share. This marks a spectacular ascent of 10.25% from the previous estimate dating back to January 16, 2024.

Analyst Projections

The price target progression springs from a blend of numerous analysts’ forecasts. The freshest projections encompass a spectrum from a low of 5.56 to a zenith of 9.98 / share, signifying an average increase of 4.26% from the latest closing market value of 8.12 / share.

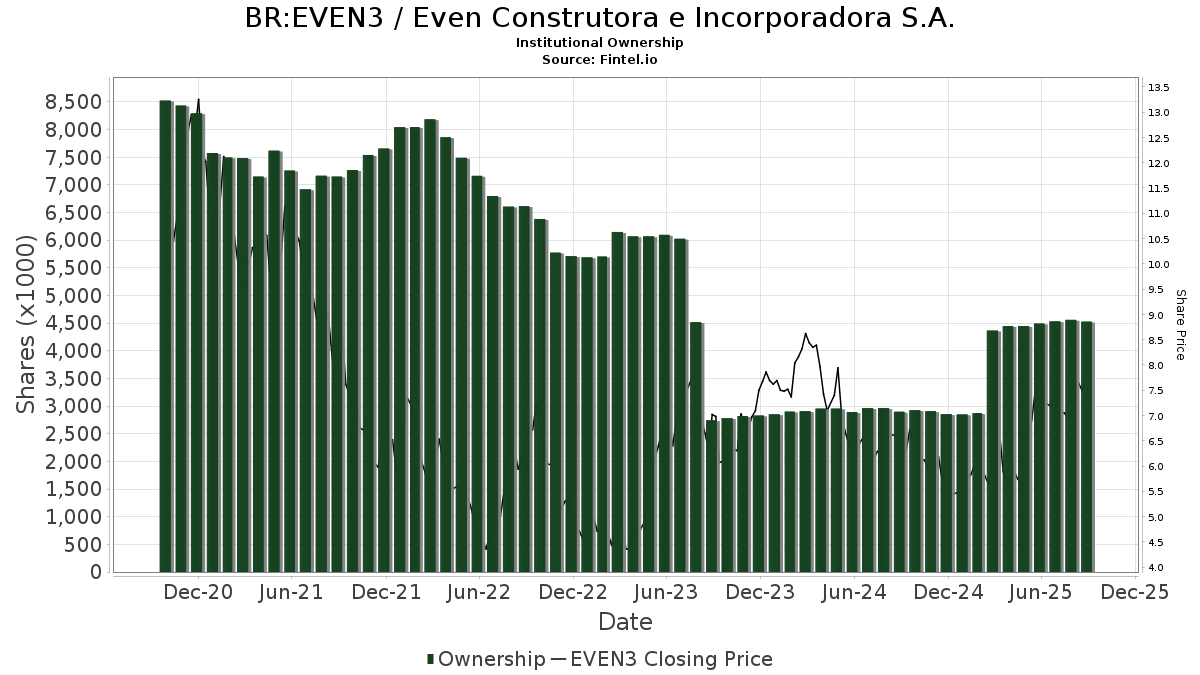

Insights into Fund Sentiment

A total of 23 funds or institutions have disclosed their stakes in Even Construtora e Incorporadora. This points to a recent increment of 4.55% or the addition of 1 more owner over the last quarter. The collective portfolio weight assigned to EVEN3 by all entities currently stands at 0.01%, reflecting a downtick of 3.54%. Institutional holdings have surged by 2.88% in the past three months to reach 2,902K shares.

Shareholder Activities

Among notable shareholders, DFCEX – Emerging Markets Core Equity Portfolio – Institutional Class, retains a stake of 0.39% in the company, holding 765K shares with no shift recorded in the previous quarter.

The Dimensional Emerging Markets Value Fund also maintains a position with 668K shares, representing 0.34% ownership, and no change registered in recent months.

DGS – WisdomTree Emerging Markets SmallCap Dividend Fund N has increased its holding to 480K shares, accounting for 0.24% ownership. The fund disclosed a rise of 2.01% from its prior filing, albeit with a 13.06% decrease in portfolio allocation to EVEN3 over the same timeframe.

Furthermore, Dfa Investment Trust Co – The Emerging Markets Small Cap Series embraced growth in its ownership by 4.05%, now owning 319K shares equating to 0.16% of the company. Their portfolio allocation in EVEN3, however, reduced by 7.93% in the last quarter.

AVEM – Avantis Emerging Markets Equity ETF, exhibiting a dynamic course, augmented its holding to 119K shares, representing 0.06% ownership. A staggering 41.11% spike from its prior filing underscores a remarkable 63.23% swell in portfolio allocation to EVEN3 over the past quarter.

Fintel stands out as an emporium of investment research catering to individual investors, traders, financial advisors, and minor hedge funds. With a global expanse, our data repository includes fundamentals, analyst appraisals, ownership insights, sentiment in various investment vehicles, insider trade revelations, options activities, peculiar trades, and an array of irreplaceable financial resources. Besides, our exclusive stock selections leverage sophisticated, rigorously tested quantitative frameworks, enhancing potential returns.

For a deeper dive into market insights, bear a visit to Fintel’s platform, where the intricacies of finance await exploration.

Initially featured on the Fintel platform.

Any opinions expressed in this narrative are solely those of the author and do not necessarily align with the perspectives of Nasdaq, Inc.