Expert Analysts Weigh In: Cardlytics Receives In-Line Rating with Promising Price Target

Analyst Forecast Indicates Significant Growth Potential

Fintel reports that on October 11, 2024, Evercore ISI Group initiated coverage of Cardlytics (NasdaqGM:CDLX) with a In-Line recommendation.

As of September 25, 2024, the average one-year price target for Cardlytics stands at $4.46 per share. Predictions vary, reflecting a low target of $3.54 and a high of $5.25. This average price suggests a potential increase of 24.30% from the most recent closing price of $3.59 per share.

Company Performance Metrics Show Positive Trajectory

The projected annual revenue for Cardlytics is estimated at $402 million, indicating an increase of 31.67%. Meanwhile, the projected annual non-GAAP EPS is set at -3.42.

Understanding Fund Sentiment

A total of 285 funds or institutions have reported positions in Cardlytics, showing a decline of 17 owners or 5.63% in the last quarter. The average portfolio weight of funds dedicated to CDLX is 0.16%, reflecting an increase of 28.32%. However, total shares owned by institutions have decreased by 4.47% over the last three months, now totaling 36,501K shares.

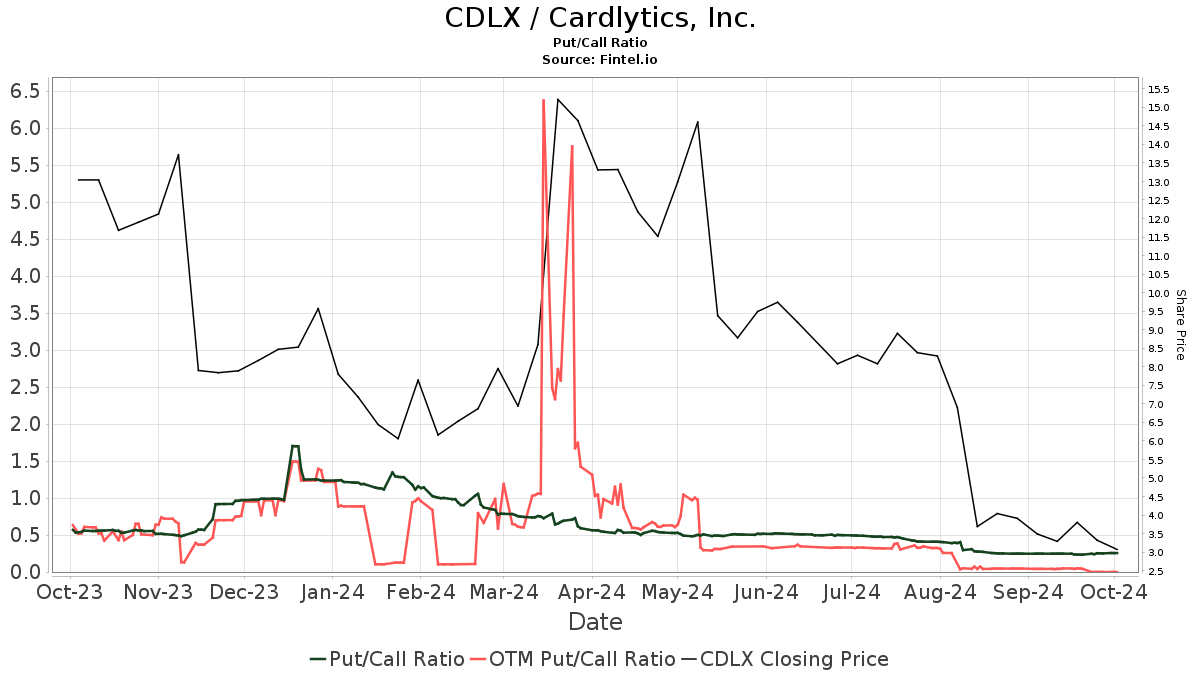

The current put/call ratio of CDLX stands at 0.25, hinting at a bullish outlook.

Actions of Key Shareholders

CAS Investment Partners has increased its holdings to 6,465K shares, which accounts for 12.97% of the company. Their previous filing showed 6,374K shares, marking an increase of 1.41%, despite a 49.91% reduction in their overall portfolio allocation.

Meanwhile, 683 Capital Management now holds 2,100K shares—representing 4.21% ownership—up from 1,997K shares, which is an increase of 4.89%. However, they have reduced their allocation in CDLX by 38.48% this past quarter.

KPS Global Asset Management UK holds steady at 1,219K shares, representing 2.45% ownership, with no changes in the last quarter. Similarly, Worldly Partners Management retains 1,158K shares for 2.32% ownership, also showing no change.

The Vanguard Total Stock Market Index Fund Investor Shares reports holding 1,135K shares, or 2.28%. This is a decrease from 1,174K shares, reflecting a reduction of 3.41% and a significant 46.72% cutback in their portfolio allocation over the last quarter.

About Cardlytics

Cardlytics Background Information

(This description is provided by the company.)

Cardlytics operates as a digital advertising platform. The company partners with financial institutions to manage their banking rewards programs, promoting customer loyalty and enhancing relationships. With access to consumer spending data, Cardlytics assists marketers in reaching potential buyers and assessing the effectiveness of marketing initiatives. The firm is headquartered in Atlanta, with offices in London, New York, San Francisco, and Visakhapatnam.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds, offering extensive data on fundamentals, analyst reports, ownership, fund sentiment, and more.

This report is part of a broader suite of resources, including advanced quantitative models for enhanced profit prospects.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.