Evercore ISI Group Begins Coverage of Cardlytics with Balanced Outlook

On October 11, 2024, Evercore ISI Group announced it has started coverage of Cardlytics (LSE:0LEC), giving the stock an In-Line rating.

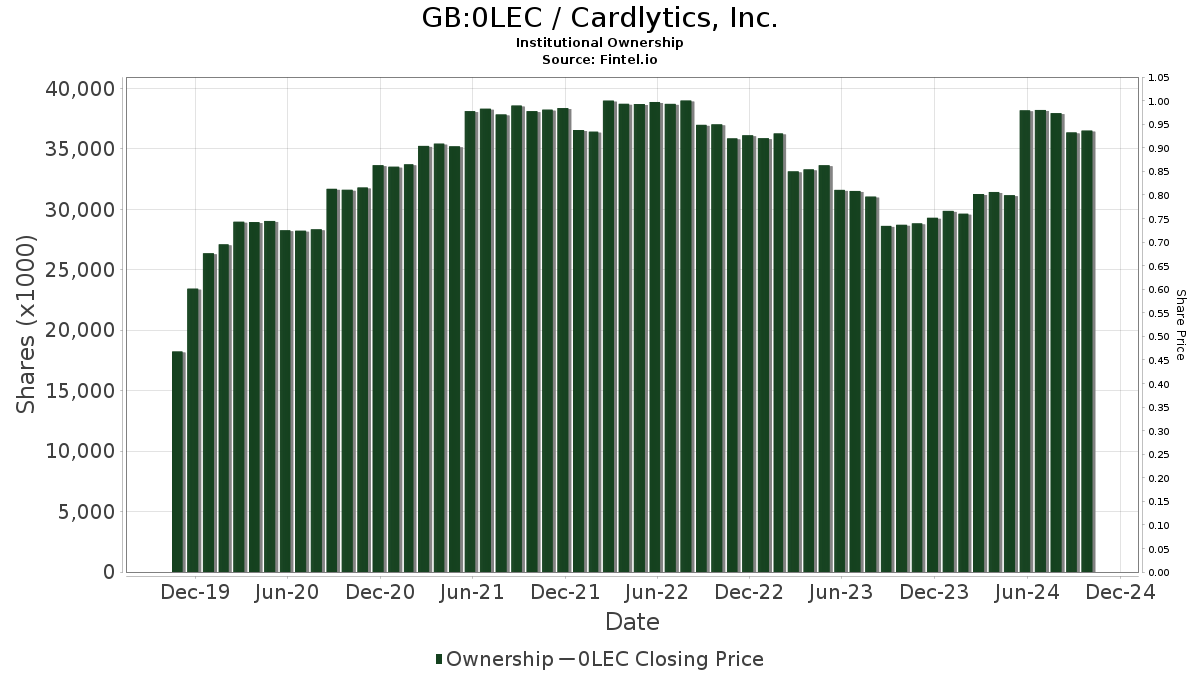

Fund Ownership Trends for Cardlytics

A total of 285 funds or institutions have reported holdings in Cardlytics, marking a decrease of 17 owners, equivalent to a 5.63% drop from the last quarter. The average portfolio weight allocated to 0LEC across all funds increased to 0.16%, a notable rise of 28.32%. Additionally, the total shares owned by institutions grew by 1.62% over the past three months, reaching 36,501K shares.

Institutional Shareholder Movements

CAS Investment Partners currently holds 6,465K shares, which accounts for 12.97% ownership of Cardlytics. This reflects an increase from the previous filing where they reported owning 6,374K shares, representing a growth of 1.41%. However, this firm has decreased its portfolio allocation in 0LEC by 49.91% in the last quarter.

683 Capital Management possesses 2,100K shares, representing 4.21% of the company. In comparison to their last report of 1,997K shares, this is an increase of 4.89%. Like other institutions, they also reduced their portfolio allocation for 0LEC by 38.48% in the previous quarter.

KPS Global Asset Management UK holds onto 1,219K shares, with no change noted in the last quarter, indicating a stable position. Similarly, Worldly Partners Management retains 1,158K shares, maintaining its stake without any adjustments.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 1,135K shares, which is a decrease from their previous report of 1,174K shares, showing a reduction of 3.41%. This firm has also cut its portfolio allocation for 0LEC by 46.72% over the last quarter.

Fintel provides a thorough research platform catering to individual investors, traders, financial advisors, and small hedge funds. Its comprehensive data includes fundamentals, analyst reports, ownership details, and market sentiment to support informed investment decisions.

This information originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.