Evercore ISI Downgrades Park Hotels & Resorts Outlook

Fintel reports that on May 16, 2025, Evercore ISI Group downgraded its outlook for Park Hotels & Resorts (LSE:0KFU) from Outperform to In-Line.

Analyst Price Target Shows Limited Upward Potential

As of May 7, 2025, the average one-year price target for Park Hotels & Resorts is set at 13.80 GBX/share. These forecasts range from a low of 10.21 GBX to a high of 21.23 GBX. The average price target indicates a modest 0.48% increase from its most recent closing price of 13.74 GBX/share.

Projected Financial Performance

The anticipated annual revenue for Park Hotels & Resorts is 3,164MM, reflecting a significant increase of 21.60%. Additionally, the projected annual non-GAAP EPS stands at 1.27.

Current Fund Sentiment

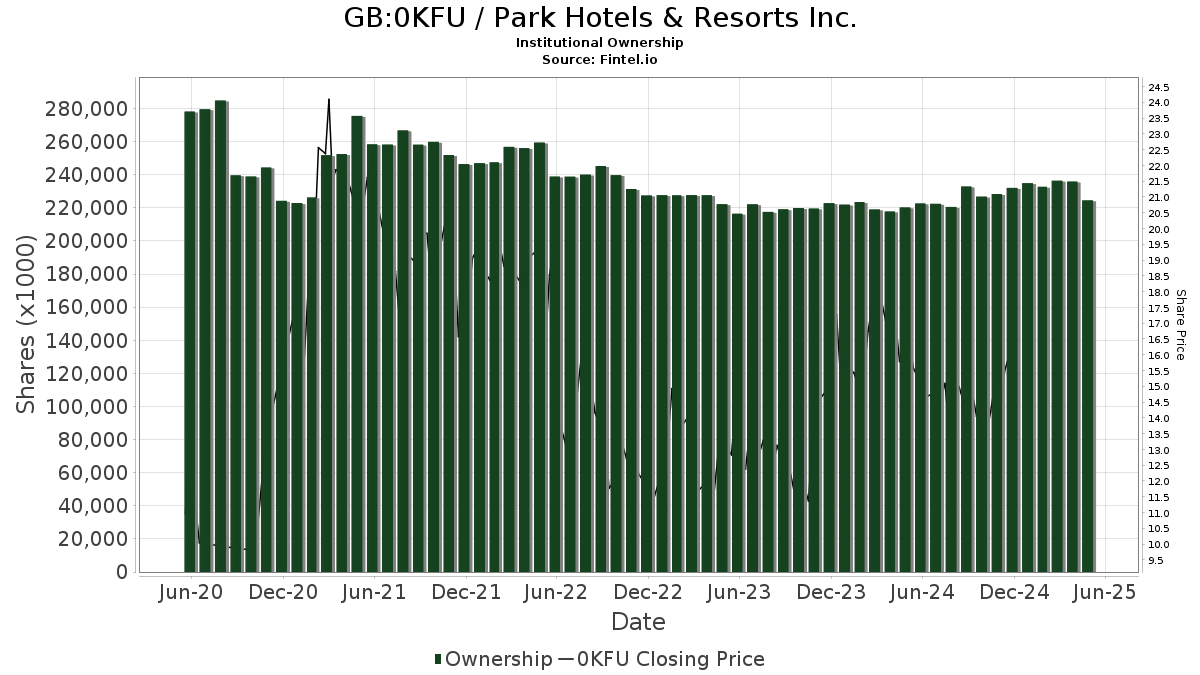

There are currently 738 funds or institutions reporting positions in Park Hotels & Resorts. This marks a decrease of 22 owners, or 2.89%, in the last quarter. The average portfolio weight for all funds holding 0KFU has risen to 0.18%, an increase of 6.84%. However, total shares owned by institutions have fallen by 3.89% over the last three months, totaling 226,382K shares.

Institutional Shareholder Activity

Donald Smith holds 11,577K shares, representing 5.79% ownership of the company. This is an increase from 9,200K shares reported previously, reflecting a 20.53% rise. However, the firm has reduced its portfolio allocation in 0KFU by 2.20% over the last quarter.

Bank of America owns 9,561K shares, or 4.78% of the company, which is up from 5,685K shares, indicating a 40.54% increase. Despite this, the firm decreased its portfolio allocation in 0KFU by 69.34% in the last quarter.

The Vanguard Real Estate Index Fund Investor Shares (VGSIX) holds 8,062K shares, or 4.03% ownership. This represents a decrease of 2.85% from the previous filing where 8,291K shares were reported, with a 0.99% reduction in portfolio allocation over the last quarter.

Arrowstreet Capital, Limited Partnership has increased its holdings to 7,632K shares (3.82% ownership), a rise of 12.31% from the previous holding of 6,692K shares. However, it has also decreased its portfolio allocation in 0KFU by 12.23% over the last quarter.

The iShares Core S&P Mid-Cap ETF (IJH) holds 6,700K shares, representing 3.35% ownership, an increase of 2.52% from its prior holding of 6,531K shares. Nonetheless, this firm has reduced its portfolio allocation in 0KFU by 1.69% during the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.