Evercore ISI Upgrades Prudential Financial Outlook: Analyst Targets 2.32% Increase

Analyst Price Forecast Highlights Potential Growth

On November 14, 2024, Evercore ISI Group changed their rating for Prudential Financial, Inc. – Corporate Bond (NYSE:PRH) from Underperform to In-Line. This revision comes amid significant examination of market trends.

Current Price Target and Projections

According to data from October 22, 2024, the average one-year price target for Prudential’s Corporate Bond is $26.58 per share. Price forecasts vary, with estimates ranging from a low of $24.59 to a high of $31.74. This price target indicates a potential growth of 2.32% from the most recent closing price of $25.98 per share.

Revenue Outlook and EPS Expectations

The projected annual revenue for Prudential Financial, Inc. – Corporate Bond stands at $55,626MM, reflecting a significant decrease of 23.76%. Additionally, the anticipated non-GAAP earnings per share (EPS) is 12.86.

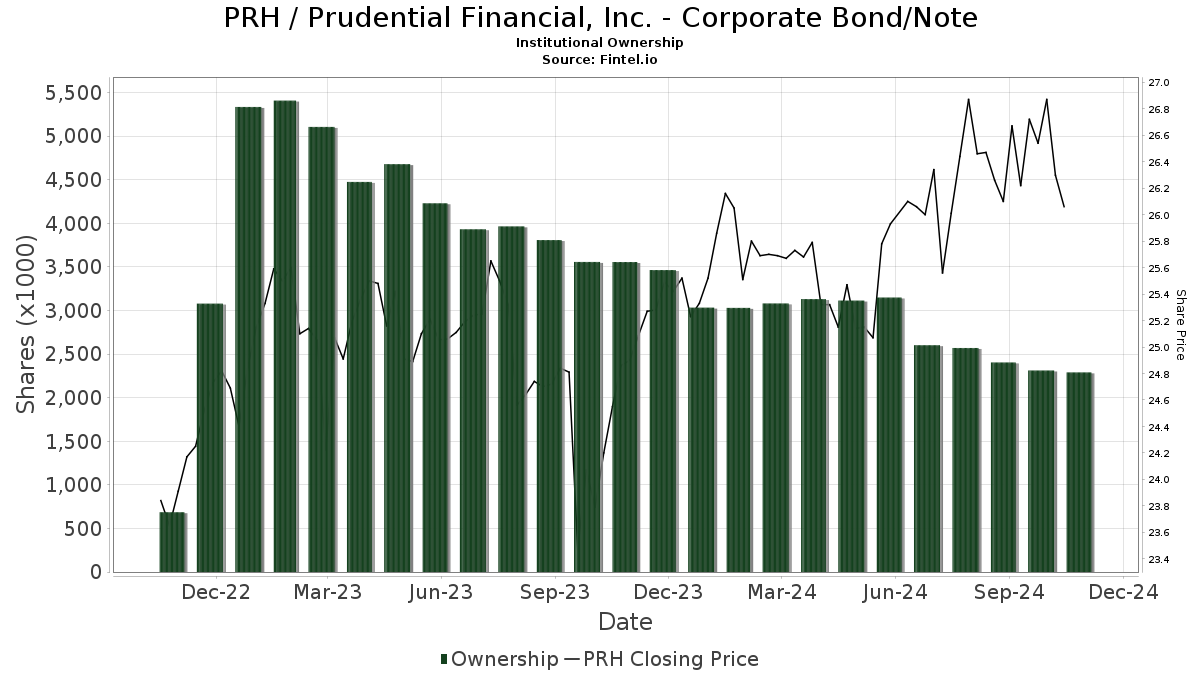

Institutional Ownership Trends

Currently, 16 funds have reported holdings in Prudential Financial, Inc. – Corporate Bond, which marks a decrease of 2 owners (or 11.11%) compared to last quarter. The average portfolio weight assigned to PRH by these funds is 0.12%, showing an increase of 17.01%. Over the past three months, total shares owned by institutions have declined by 10.90% to 2,291K shares.

Movements in Institutional Holdings

PFF – iShares Preferred and Income Securities ETF currently possesses 1,138K shares, a decrease from the 1,164K shares it held previously, reflecting a drop of 2.29%. However, it increased its investment in PRH by 2.84% over the past quarter.

PGX – Invesco Preferred ETF’s holdings decreased by 2.58%, with the firm now owning 495K shares down from 507K shares. The fund also reduced its portfolio allocation in PRH by 1.14% during the last quarter.

PFFD – Global X U.S. Preferred ETF slightly increased its stake, now holding 241K shares, compared to 240K shares previously, representing a growth of 0.66%. This fund has also increased its portfolio allocation by 1.00%.

Moreover, PNARX – Spectrum Preferred and Capital Securities Income Fund holds 181K shares, down from 182K shares, which is a reduction of 0.57%. The fund has lowered its PRH allocation by 0.27% during the last quarter.

Lastly, PSK – SPDR(R) Wells Fargo Preferred Stock ETF holds 140K shares, an increase from 138K shares, which indicates a 0.94% rise in holdings and a 3.34% increase in portfolio allocation.

Fintel provides one of the most comprehensive investing research platforms for individual investors, traders, financial advisors, and small hedge funds. Our data encompasses fundamentals, analyst reports, ownership details, fund sentiment, options activity, insider trading, and more. Our proprietary stock picks utilize advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.