Evercore ISI Group Upgrades BorgWarner: What Investors Should Know

Fintel reports that on October 14, 2024, Evercore ISI Group upgraded their outlook for BorgWarner (LSE:0HOU) from In-Line to Outperform.

Positive Price Forecast Ahead

As of September 25, 2024, the average one-year price target for BorgWarner stands at 41.29 GBX/share. Predictions range from a low of 32.35 GBX to a high of 49.39 GBX. This average price target indicates a potential increase of 17.18% from its latest reported closing price of 35.24 GBX/share.

Projected Revenue Growth

BorgWarner is anticipated to reach a projected annual revenue of 18,872MM, reflecting a rise of 31.59%. Additionally, the expected annual non-GAAP EPS is 5.78.

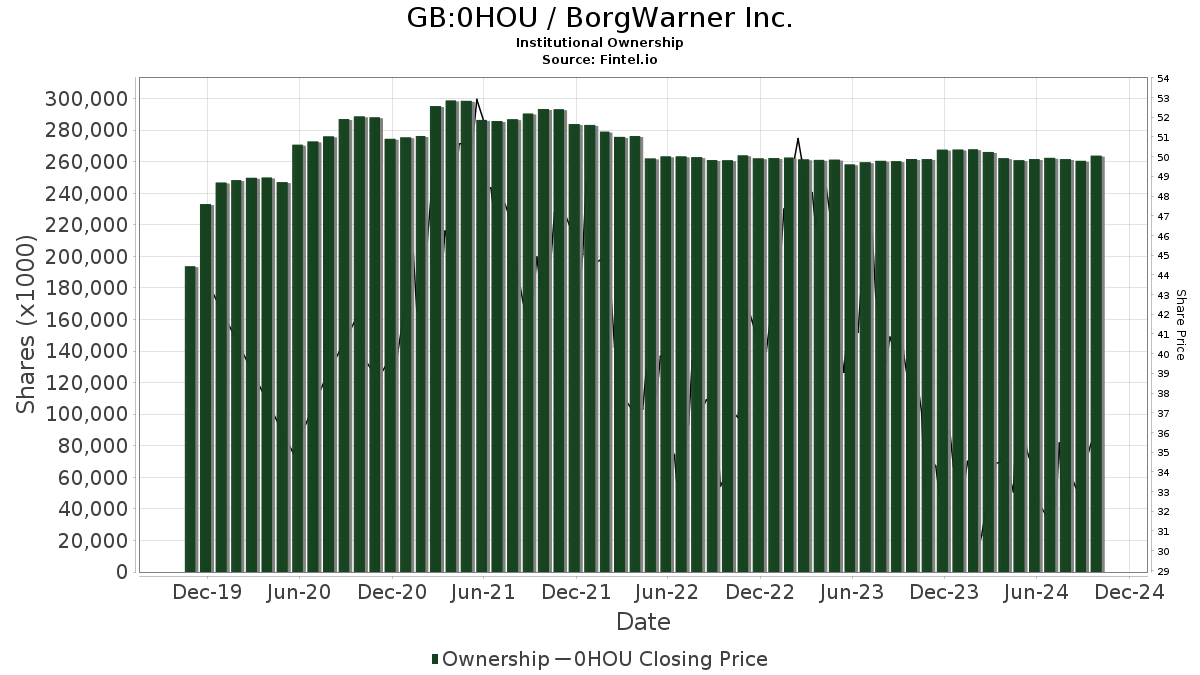

Institutional Investor Sentiment

As of now, 1,324 funds or institutions have reported positions in BorgWarner, down by 22 owners, or 1.63%, in the last quarter. The average portfolio weight dedicated to 0HOU among all funds is 0.19%, which marks an increase of 3.57%. In total, institutional ownership rose by 2.10% over the past three months, now totaling 263,789K shares.

Trading Activity of Major Shareholders

Victory Capital Management currently holds 12,984K shares, which represents a 5.70% ownership stake in the company. Previously, the firm owned 13,091K shares, marking a decrease of 0.82%. This firm has reduced its portfolio allocation to 0HOU by 39.52% over the last quarter.

Harris Associates L P owns 10,623K shares, equating to 4.66% ownership. In its last report, it stated ownership of 10,602K shares, showing a slight increase of 0.20%. However, its portfolio allocation to 0HOU was decreased by 4.88% in the past quarter.

VETAX – Victory Sycamore Established Value Fund holds 9,130K shares, representing 4.01% ownership, which is up from 8,949K shares—a growth of 1.98%. The firm has increased its allocation in 0HOU by 1.18% over the previous quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 7,223K shares or 3.17% ownership but has slightly reduced its holding from 7,245K shares—a decrease of 0.31%. This fund cut its allocation in 0HOU by 10.03% recently.

OAKMX – Oakmark Fund Investor Class maintains 6,620K shares, representing 2.91% of the company, with no changes in its position last quarter.

Fintel is a leading investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our comprehensive data comprises fundamentals, analyst reports, ownership data, fund sentiment, insider trading, options sentiment, and much more. Moreover, our exclusive stock picks are backed by advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.