On November 7, 2025, Evercore ISI Group reaffirmed its Underperform rating for Under Armour (NYSE:UA). The average one-year price target for the company stands at $5.93 per share, representing a potential increase of 33.22% from its latest closing price of $4.45.

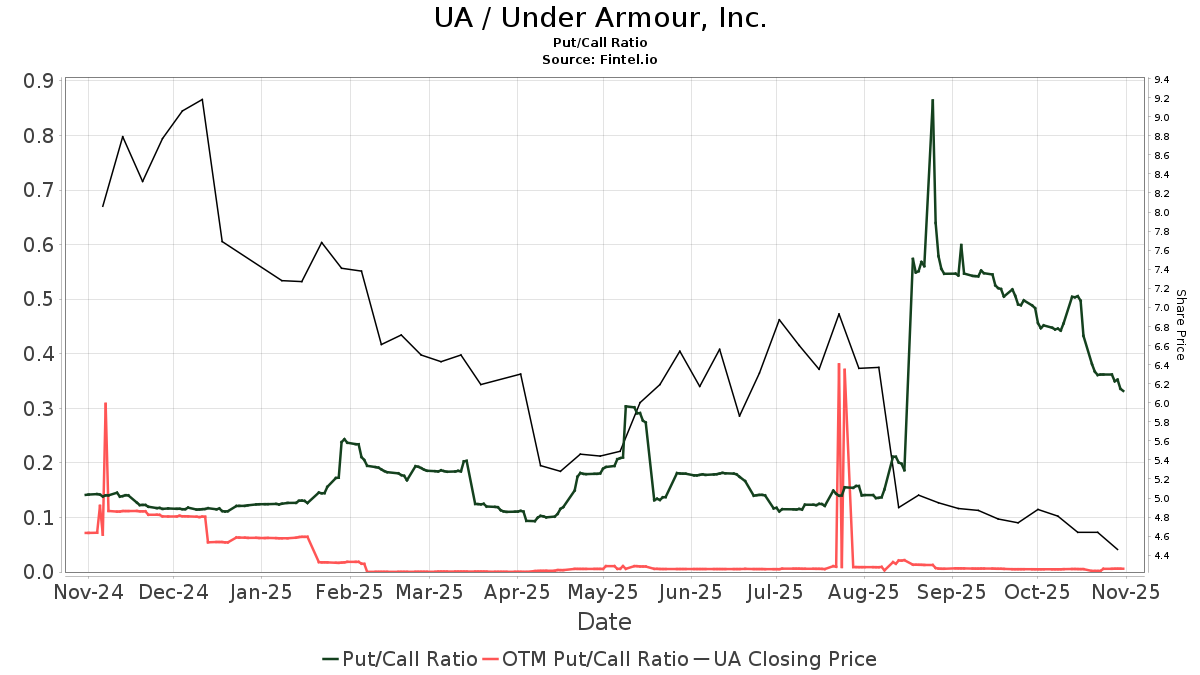

Under Armour’s projected annual revenue is $6.66 billion, marking a 31.91% increase, with a projected non-GAAP EPS of 0.96. Institutional ownership saw a decrease of 1.38% in total shares over the last three months, with 175.08 million shares currently held by institutions. The put/call ratio for UA is 0.32, indicating a bullish sentiment.

Major shareholders include Bdt Capital Partners with 30.39% ownership, and VTSMX, which holds 2.44% of the shares but has decreased its position by 9.97% in its last filing.