Diving into the Analysts’ Price Projections

The once optimistic terrain of EVT (ASX:EVT) seems to be facing a stormy forecast, with the average one-year price target now sailing towards 13.48 per share—a 6.31% decrease from the earlier projected 14.38 documented on January 16, 2024. These estimates are cultivated from a versatile range of projections by market analysts, fluctuating drastically between a low anchor of 11.42 and a high peak of 16.43 per share. The present target indicates a buoyant 20.87% surge from EVT’s latest recorded closing price of 11.15 per share.

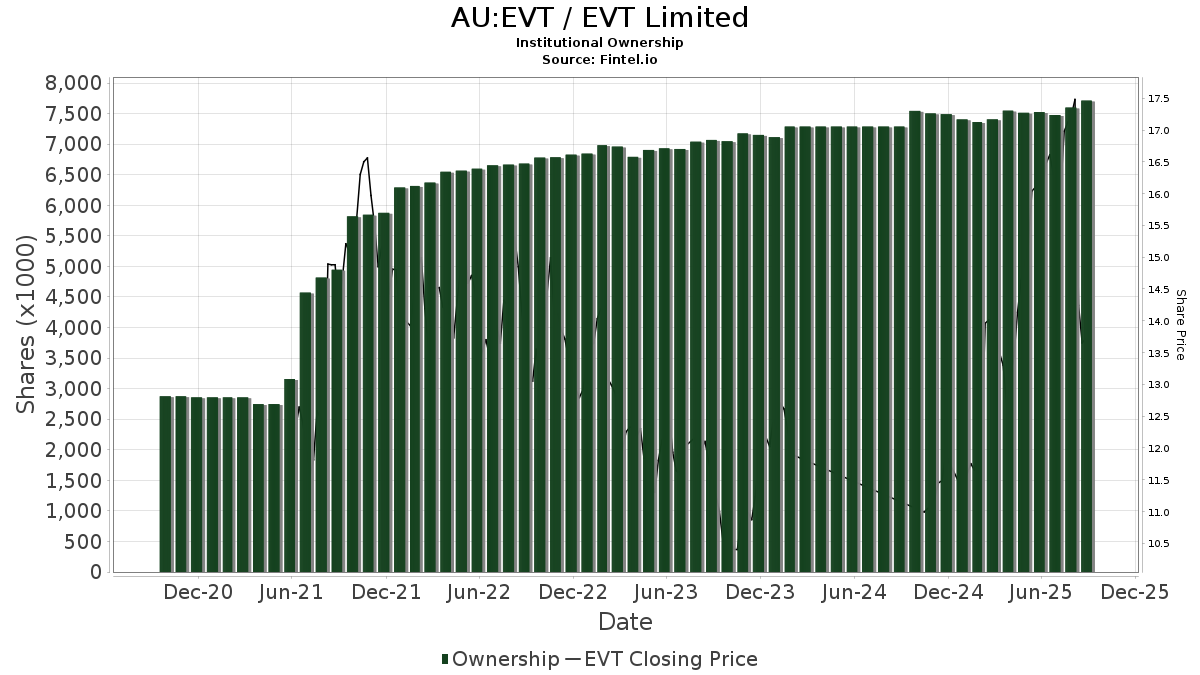

Exploring Fund Sentiment and Institutional Moves

Current figures indicate that 51 funds and institutions are actively involved with EVT, showcasing a modest decline in ownership by 1.92% in the last quarter. The prevalent stance shows that the average portfolio weight allocated to EVT across all funds has simmered down to 0.03%, marking a decline of 2.94%. However, there seems to be a flicker of hope as the total shares owned by institutions have seen a mild resurgence, climbing by 1.56% over the past three months to reach 7,290K shares.

Anecdotes from Other Shareholders

Among key shareholders, VGTSX – Vanguard Total International Stock Index Fund Investor Shares holds 1,520K shares, embodying a 0.94% stake in the company. Recent filings reveal an upswing in their ownership by 2.52%, contrasting with an 8.23% pullback in portfolio exposure to EVT over the previous quarter. On similar lines, VTMGX – Vanguard Developed Markets Index Fund Admiral Shares is now holding 846K shares, translating to a 0.52% ownership chunk. Their ownership has staggered down by 4.19%, with a substantial 10.16% decrease in portfolio allocation linked to EVT in the last quarter.

Delving deeper, Dfa Investment Trust Co reported a decreased ownership with 647K shares representing 0.40% of the company. This portrays a decline of 2.44% in shares owned and a noteworthy 10.65% dip in their EVT portfolio allocation over the last quarter. On a diverse note, AVDV – Avantis International Small Cap Value ETF showcases marked growth in their EVT ownership, with shares up to 613K indicating a 0.38% stake. Their ownership surged by 29.71%, contrasting with a minor 2.78% reduction in portfolio exposure to EVT.

IEFA – iShares Core MSCI EAFE ETF stands with an ownership of 596K shares, reflecting a 0.37% stake in the company. An amplified ownership of 2.21% showcases a promising outlook, although a significant 9.77% slice has been deducted from their EVT portfolio allocation in recent times.

Immersing into the pools of financial insights, Fintel emerges as an island of investment research, catering not just to individual investors but acting as a beacon for traders, financial advisors, and small hedge funds exploring the vast ocean of financial data. With a repository covering global fundamentals, analyst reports, ownership insights, fund sentiment, and much more, Fintel aims to empower investors through data-driven decisions and exclusive stock picks fuelled by advanced quantitative models.

Tap into the depth of financial wisdom, explore the possibilities, and set sail towards informed investment choices.

This narrative originated on Fintel.

The views and opinions presented herein reflect those of the author and do not necessarily mirror the stance of Nasdaq, Inc.