Understanding the Ex-Div Reminder

Bank of America Corp’s 5.000% Non-Cumulative Preferred Stock, Series LL (Symbol: BAC.PRN) is set to go ex-dividend on 2/29/24, offering a quarterly dividend of $0.3125 per share, payable on 3/18/24. When measured against BAC.PRN’s recent share price of $22.87, this dividend equates to around 1.37%. As a result, expect BAC.PRN shares to potentially trade 1.37% lower on 2/29/24. The current annual yield stands at approximately 5.46%, presenting a slightly lower figure compared to the 6.70% average within the “Financial” preferred stock category, as detailed by Preferred Stock Channel.

Riding the Waves: Performance Overview

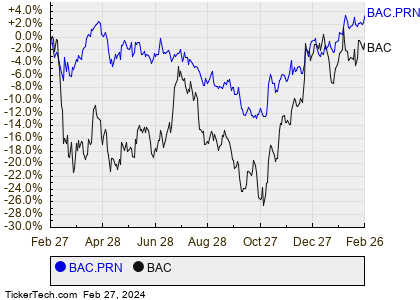

A visual representation of BAC.PRN’s one-year performance against BAC common shares can be seen in the chart below, illustrating the fluctuations in stock value and highlighting the impact of dividends:

Below, you’ll find a dividend history chart for BAC.PRN, showcasing the historical dividends leading up to the most recent $0.3125 payment on Bank of America Corp’s 5.000% Non-Cumulative Preferred Stock, Series LL:

A Tale of Markets: Trading Dynamics

During Tuesday’s trading session, while Bank of America Corp’s 5.000% Non-Cumulative Preferred Stock, Series LL (Symbol: BAC.PRN) remained steady, its common shares (Symbol: BAC) enjoyed a healthy 2% increase, highlighting the intricate dance between preferred and common stock movements and investor sentiment.

Insights Beyond Numbers

When delving into the universe of dividend stocks, it’s essential to examine a broader spectrum. Consider exploring which S.A.F.E. dividend stocks also offer preferred shares that could add depth and diversity to your investment portfolio. Don’t miss out on intriguing opportunities that might be on the periphery of your radar screen.

For Further Consideration

Dive deeper into the preferred stock offerings of Utilities Stocks Hedge Funds are investing in.

Track the trajectory of funds holding GGLL, and uncover potential investment strategies.

Explore the outstanding history of CDAQ shares to gain insights into market movements.

The thoughts and perspectives shared here represent the author’s opinions and do not necessarily mirror those of Nasdaq, Inc.