“`html

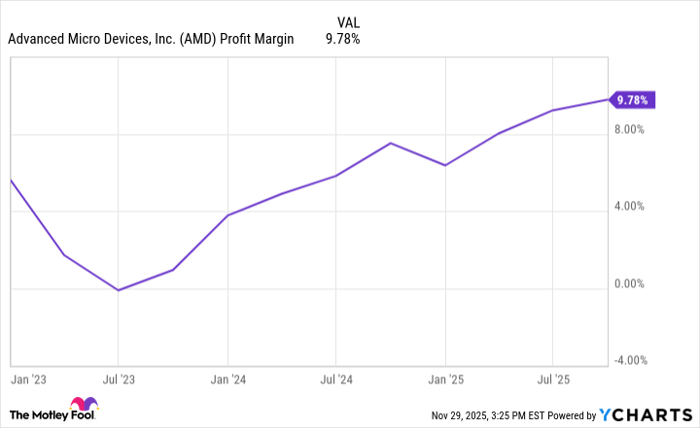

Nvidia and Alphabet: AI Market Dynamics

Nvidia (NASDAQ: NVDA) currently holds approximately 90% of the AI accelerator market, recently posting $57 billion in quarterly revenue and a 66% annual growth in its data center business. However, Alphabet (NASDAQ: GOOGL, GOOG) is emerging as a formidable competitor with its Tensor Processing Unit (TPU) chips, specifically the TPU v7 Ironwood, which offers significant cost advantages for inference workloads.

As of now, nine of the top ten AI labs utilize Google Cloud, which offers external access to its TPU chips. Major clients such as Apple have opted for Alphabet’s silicon for AI applications, training its models on 8,192 Google TPU v4 chips, while Anthropic has secured access to up to 1 million TPUs through a multi-billion dollar partnership. Analysts predict that by 2026, inference revenue will surpass training revenue across the industry.

Despite Nvidia’s stronghold in model training, Alphabet’s competitive pricing and the growing recognition of its TPU platform indicate that the AI market is becoming more diversified, potentially putting pressure on Nvidia’s margins. Google’s cloud revenue surged 34% to $15.2 billion last quarter, with an 82% increase in cloud backlog year-over-year to $155 billion.

“`