Chegg, Inc. (CHGG) is pivoting its business model to focus more on business-to-business (B2B) partnerships due to a significant 42% decline in total revenues year-over-year in Q3 2025. This shift responds to challenges posed by generative AI and decreased visibility on Google search, leading to a nearly 50% reduction in legacy traffic. The academic segment alone suffered a revenue drop of over 40% during the same period.

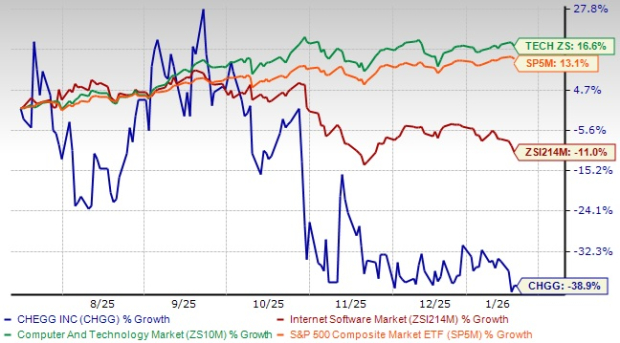

To enhance revenue stability, Chegg is prioritizing B2B skilling operations that are based on contracted relationships and more predictable usage patterns. The company has experienced a 38.9% drop in stock price over the last six months, trailing behind industry peers. Despite these setbacks, Chegg’s earnings per share estimate for 2026 remains unchanged at 18 cents, with projected growth of 228.6%.