Apple Navigates Trade Turbulence Ahead of Chinese Tariffs

Over the past few weeks, tariffs have been a major topic in financial discussions, overshadowing other key events and driving market volatility.

Although proposed tariffs on Mexico and Canada have been postponed for 30 days, the 10% tariffs on Chinese goods are set to go into effect this week, starting February 4th.

This initial round of tariffs is intended as a preliminary measure. President Trump and Chinese President Xi Jinping are expected to engage in talks soon that will influence the future direction of these tariffs.

Currently, investor-favorite Apple AAPL finds itself affected by these developments, particularly due to its substantial reliance on iPhone manufacturing in China. Let’s take a deeper look at Apple’s situation and its recent quarterly performance.

Are Apple’s Sales at Risk?

Apple’s recent iPhone sales results showed a slight decline, despite the rollout of Apple Intelligence. The company reported iPhone sales of $69.2 billion, marking a year-over-year drop of about 1%, which also missed analyst expectations.

Image Source: Zacks Investment Research

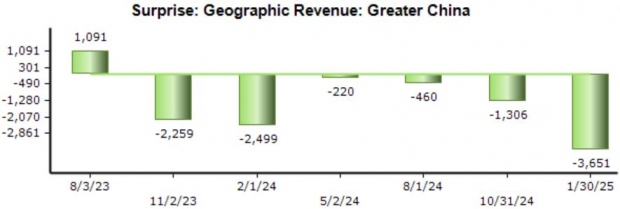

In China, Apple has faced increasing competition, with sales declining to $18.5 billion from $20.8 billion in the same quarter last year. While this slowdown has been acknowledged over several reporting periods, it still presents a challenge for the tech giant.

Image Source: Zacks Investment Research

Despite the concerning tariff news, Apple has strategies to lessen its effects. One way could be raising U.S. prices, although this could lead to decreased demand.

Furthermore, Apple has been proactive in diversifying its supply chain. The company has been expanding production to countries such as India and Vietnam, reducing its reliance on Chinese manufacturing.

Conclusion

Although tariffs pose a potential risk for Apple AAPL due to its significant manufacturing exposure, the company has shown flexibility to adapt. Shifting more production to other regions, alongside the possibility of increasing U.S. prices, could help navigate these challenges.

For the time being, market conditions seem uncertain, and investors are advised to monitor developments closely, especially in light of the recent suspension of tariffs on imports from Mexico and Canada.

Only $1 to Access All Zacks’ Recommendations

We’re not joking.

A few years ago, we surprised our members with a promotion allowing 30-day access to all our stock picks for just $1. No further obligation required.

Thousands have taken advantage of this incredible offer, while others hesitated, suspecting a catch. The truth is, we want you to experience our exceptional portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and many more, which collectively achieved double- and triple-digit gains on 228 positions in 2023 alone.

Get a free stock analysis report on Apple Inc. (AAPL).

Read the full article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.