“`html

Tariffs vs. Technology: Why AI Is the Real Job Threat

Hello, Reader.

Tom Yeung here with today’s Smart Money.

Last Saturday, Donald Trump made headlines again. The news focused on DeepSeek-R1, an affordable yet robust AI model from China, which is challenging the innovations of OpenAI and Google.

However, the spotlight quickly changed.

The discussion moved from AI’s potential to disrupt the job market to Trump’s proposal for new tariffs. He suggested a 25% tax on imports from Canada and Mexico and a 10% tax on Chinese goods. While the official reason was to combat illegal immigration and fentanyl, many believe his true aim was to increase tax revenues, revive American manufacturing, and secure U.S. employment.

If implemented, these tariffs might succeed in raising tax income and could potentially help bolster some manufacturing roles that have moved overseas.

Nevertheless, for the 80% of Americans employed in service-oriented jobs, the genuine threat is not from cheaper imports.

It stems from advancements like DeepSeek-R1.

Artificial intelligence does not require factories or foreign labor; it only relies on computer resources. As AI technologies progress rapidly, tariffs seem outdated against such a force. Millions of jobs are expected to change or disappear in the ensuing decade, and taxes on imports won’t change this reality.

To help you navigate this evolving landscape, I recommend watching Eric’s latest presentation, 1,000 Days to AGI. In it, he explains how advancements in AI might affect American employment and how you can prepare financially. Meanwhile, let’s delve deeper into the implications of foreign AI and the urgency of adapting.

We will explore why attempts to regulate or tax foreign AI are ineffective, highlight how AI is currently displacing workers, and discuss the timeline for achieving artificial general intelligence (AGI).

Let’s begin…

DeepSeek-R1: The Real Job Threat

For years, Washington has attempted to curb China’s advances in AI by blocking exports of high-performance microchips.

The strategy was straightforward: if China could not access powerful computing technology, it would struggle in AI development.

This tactic has not succeeded.

As noted in past discussions here at Smart Money, DeepSeek-R1 demonstrates that China has found ways to make substantial improvements without high costs. Reports indicate that the startup trained this advanced model for a mere $5.6 million—a budget that Andrej Karpathy, the former head of AI at Tesla Inc. (TSLA), called “a joke.” Its capabilities are so impressive that it rivals the best from OpenAI and Alphabet Inc. (GOOGL).

Moreover, other Chinese firms are also advancing. On January 29, Chinese e-commerce heavyweight Alibaba Group Holding Ltd. (BABA) introduced its latest large language model (LLM), Qwen2.5 Max, which is nearly equal in performance to OpenAI’s o1-mini but is offered at half the price.

Earlier this week, TikTok’s parent company, ByteDance, unveiled an AI system, OmniHuman-1, capable of producing incredibly lifelike deepfake videos. As TechCrunch put it, it can create “the most realistic deepfake videos to date.” Historical speeches and events can now be simulated with ease; the example below shows a lecture by Albert Einstein that never transpired.

This context makes the recent 10% tariff increase on Chinese goods relatively insignificant for employment protection. Nowadays, anyone with internet access can download DeepSeek’s newest model for free and modify it accordingly. There are no “imports” subject to taxes.

You may wonder what deepfake technology and free tools have to do with the job market. To clarify, tariffs may help shield sectors threatened by foreign labor competition.

However, AI isn’t competing with foreign workers—it’s replacing them entirely. Unlike previous job losses that resulted from outsourcing, these positions are unlikely to return.

The tough reality is that we must make a choice: prepare financially or risk being left behind. A poll from last year indicated that 30% of American businesses have already substituted some workers with AI, with another 38% planning to do so by 2025.

And that’s only a glimpse of what’s ahead…

1,000 Days to AGI

DeepSeek’s achievements illustrate that Chinese companies could potentially develop superintelligent AI before their American counterparts. Consequently, companies like OpenAI and Alphabet are investing heavily to stay ahead. Proposals to ban Chinese AI, such as the one introduced last week by Senator Josh Hawley, a Republican from Missouri, may not be effective if OpenAI produces a competitive alternative.

The outcome?

Experts predict that artificial general intelligence will emerge within the next 1,000 days, regardless of tariff implementations. This milestone marks when AI could perform many tasks traditionally done by humans. The timeline for achieving AGI is much shorter than many realize.

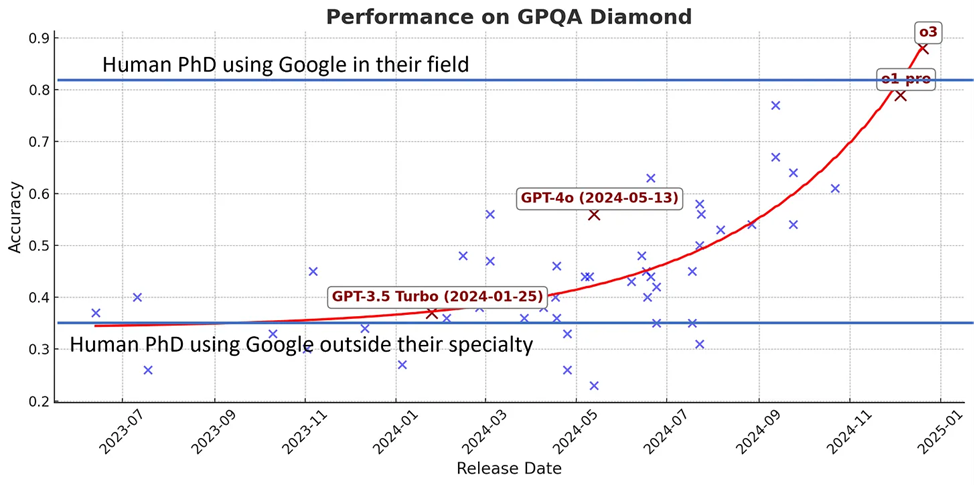

A recent study showed that PhD-level…

“`

OpenAI’s Advancements: A Game Changer for AI and Investors

AI Outperforms Experts

Recent findings by Ethan Mollick, a management professor at the Wharton School, reveal that OpenAI’s new “o3” model now answers questions more effectively than leading human researchers who have internet access.

The Future of AI is Accelerating

This advancement suggests that AI technology will continue to evolve rapidly. Echoing a sentiment from the classic Bachman–Turner Overdrive song, “You ain’t seen nothing yet,” the potential growth of AI is significant.

Opportunity Awaits Early Adopters

Getting ready for this impending shift is crucial. Companies that adopt AI technology early stand to gain substantial wealth. A new wave of millionaires is likely to emerge from those who invest in these pioneers. In contrast, companies that delay will likely struggle, leaving their investors disappointed.

The AI Revolution is Now

The transformation driven by AI is already in motion and doesn’t plan to slow down.

Therefore, I encourage you to click here and view Eric’s free broadcast, 1,000 Days to AGI, to position yourself ahead of what could be the largest wealth shift of our time.

Best regards,

Thomas Yeung

Markets Analyst, InvestorPlace

P.S. In turbulent market conditions, one asset shows promise: crypto.

Luke Lango predicts that the early days of Former President Trump’s next term may create a brief but significant opportunity in the crypto space, motivating him to launch The Great American Crypto Project.

This morning, during a special presentation, a new investment strategy was unveiled. This proprietary algorithm aims to identify rapid-growth cryptocurrencies that might boost your investment tenfold, fiftyfold, or even one hundredfold in 90 days or less.

For a limited time, catch a replay of this event by clicking here.