“`html

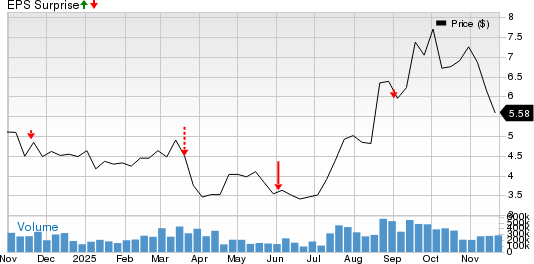

This week, PepsiCo (PEP) and Delta Air Lines (DAL) are set to report their quarterly results on Thursday, October 9th. Pepsi is anticipated to report earnings of $2.27 per share on revenues of $23.88 billion, reflecting year-over-year changes of -1.7% and +2.4%, respectively. Delta is expected to report earnings of $1.60 per share on $15.93 billion in revenues, showing year-over-year increases of +6.7% and +1.6%.

As of now, the S&P 500 is projected to see an overall earnings growth of +5.4% for Q3, with revenues expected to rise by +6.1%. So far, 19 S&P 500 companies that have reported for their fiscal quarters ending in August have shown a total earnings increase of +11.9%, with 73.7% surpassing EPS estimates and 78.9% exceeding revenue estimates.

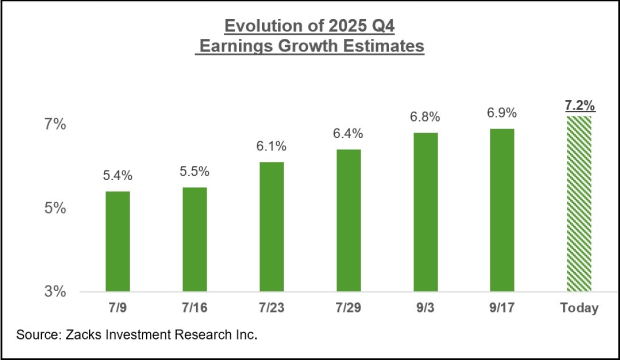

Looking ahead, Q4 estimates have also improved with 7 of the 16 sectors, including Tech, Finance, and Energy, witnessing positive revisions, while Consumer Discretionary and Medical sectors remain under pressure. The Tech sector is projected to grow by +11.9% in earnings for Q3, highlighting its importance in the overall market performance.

“`