Costco Likely to Split Shares as Price Hits New Heights

Statistical data shows that stocks typically outperform the market in the year following a split. Though this seems illogical since it doesn’t correlate with a company’s underlying performance, stock splits tend to generate returns between 25% and 30%, often surpassing the returns of the S&P 500.

Start Your Mornings Smarter! Receive Breakfast news delivered to your inbox every market day. Sign Up For Free »

Many Companies Anticipate Stock Splits in 2025

As several companies like Nvidia plan stock splits in 2024, a key question arises: which firms will follow suit in 2025? In my view, Costco Wholesale (NASDAQ: COST) seems overdue for a stock split next year. Let’s explore why Costco may split its shares in 2025 and evaluate whether it still represents a sound investment today.

Rising Share Price Nears Major Milestone

Costco’s shares are approaching the $1,000 mark, a common threshold for companies considering a stock split. A split would allow more individual investors to purchase smaller portions of the company.

The last stock split occurred in 2000, when Costco executed a two-for-one split. Prior to this, it split its shares in 1993. Since the start of 2000, Costco’s stock has surged nearly 2,000%. Given that it’s been almost 25 years since its last split, and with shares nearing $1,000, another split seems imminent.

Strong Business Performance Justifies Potential Split

The possibilities for a stock split are increasing, but how is Costco’s business performing? Impressively well.

In the last five years, Costco’s revenue has climbed by 63%, totaling $259 billion over the past year. Thanks to its wholesale membership model, Costco retains customer loyalty with consistently low prices. This business model thrives whether the economy faces recession or growth, ensuring revenue continues to rise each year.

Earnings have escalated even faster. Over the last five years, earnings per share (EPS) have doubled, primarily due to growing profit margins. Operating margins, for instance, have improved from just above 3% to 3.67% in the same timeframe. While this may seem minor, such a shift is significant for a company like Costco, which operates with narrow profit margins.

Given its solid business foundation, I expect Costco’s revenue and EPS to show steady growth over the next five to ten years. Customers appreciate Costco’s value, and I see no signs that will change.

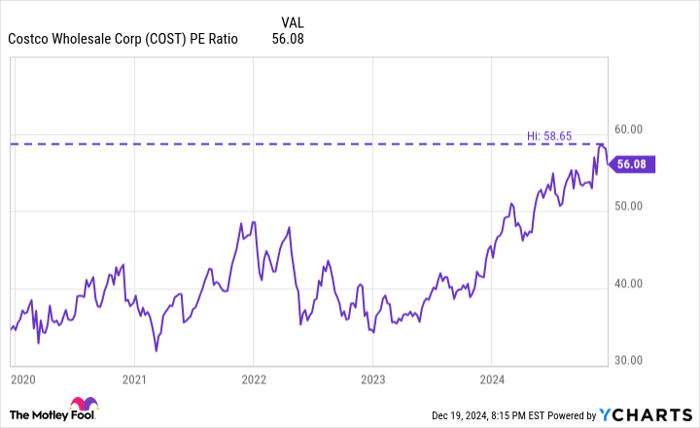

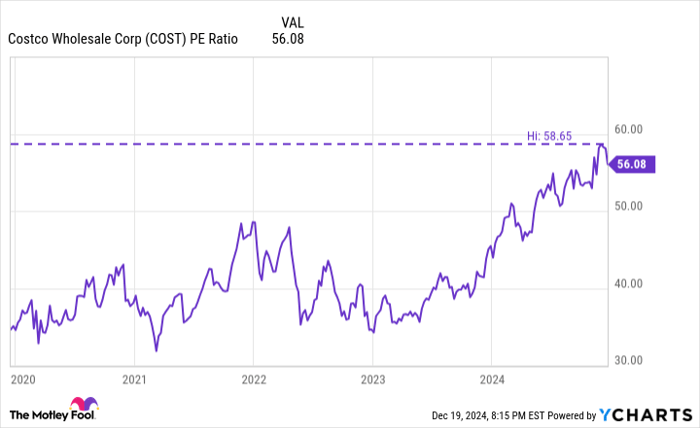

COST PE Ratio data by YCharts.

Long-Term Focus Is Crucial for Investment

Costco has proven to be a reliable business and a strong performer in the stock market historically. Nevertheless, a potential stock split does not automatically mean it is a wise investment choice right now.

While stock splits garner short-term attention, they do not significantly impact share price returns over three to ten years. What matters most is the price investors pay for the stock and its earnings growth over time.

Currently, Costco has a price-to-earnings (P/E) ratio of 56, which is near its all-time high set earlier this month. Such a high P/E ratio seems misaligned with a company like Costco, which operates in a relatively mature industry, generating over $250 billion annually.

If we assume Costco could grow its EPS by 100% over the next five years, the P/E ratio would fall to 28, approximately matching the S&P 500 average. This scenario is contingent upon optimistic growth expectations tied to recent inflation. As it stands, many years of future earnings growth appear to be already reflected in Costco’s stock price.

No matter how well a business performs, the valuation at which you buy shares is critical. Given Costco’s status as a low-growth company trading at a record-high earnings multiple nearing 60, I advise exercising caution before purchasing shares.

Is Costco Wholesale a Good Investment Today?

Before deciding to invest in Costco Wholesale, it’s essential to consider the following:

The Motley Fool Stock Advisor team recently highlighted what they believe to be the 10 best stocks for investors right now—and Costco Wholesale was not included. The stocks selected could provide substantial returns in the upcoming years.

An example of this is when Nvidia was highlighted on April 15, 2005… if you invested $1,000 at that time, you’d have $855,971! *

Stock Advisor offers investors an easy path to success, featuring portfolio-building guidance, ongoing updates from analysts, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500’s return by more than four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.