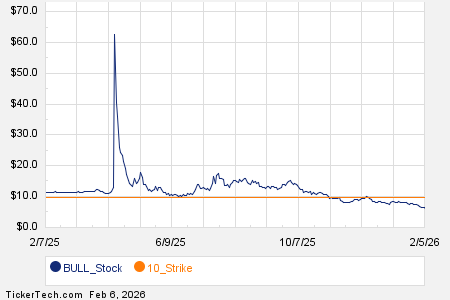

Amazon’s $200 Billion Expenditure Forecast Surprises Wall Street

Amazon CEO Andy Jassy announced the company’s plan for approximately $200 billion in capital expenditures by 2026, largely to bolster its fast-growing cloud computing sector, Amazon Web Services (AWS). This ambitious forecast has pressured Amazon’s stock, which is down over 10% year-to-date. Jassy reassured investors of expected strong returns on these investments, emphasizing the company’s capability to monetize capacity effectively.

Additionally, Jassy highlighted the growth of Amazon’s chip business, which is now generating an annualized revenue run rate of over $10 billion, expanding at a triple-digit rate. He noted that demand for AI chips is increasing, with competitors slow on pricing adjustments, positioning Amazon favorably in this space.

The company’s fourth-quarter earnings showed a 14% year-over-year increase in net sales, reaching $25 billion in operating income, as well as guidance for a 11% to 15% revenue growth for Q1, projecting between $173.5 billion and $178.5 billion. This has led to speculation that the stock may be undervalued following its recent dip.