Expedia Group Reports Mixed Q1 Earnings; Offers 2025 Guidance

Expedia Group (EXPE) reported first-quarter 2025 adjusted earnings of 40 cents per share, falling short of the Zacks Consensus Estimate by 4.76%. This marked a significant 90.5% increase from the same quarter last year.

Over the past four quarters, EXPE’s adjusted earnings beat the Zacks Consensus Estimate three times, missing once with an average earnings surprise of 5.48%.

See the Zacks earnings Calendar to stay ahead of market-making news.

Revenues stood at $2.98 billion, up 3.4% year over year, but also missed the Zacks Consensus Estimate by 1.27%.

Business-to-Business (B2B) revenues increased 13.7% year over year to $947 million, while Business-to-Consumer (B2C) revenues declined by 1.5% to $1.96 billion.

Advertising revenues notably surged by 20% year over year.

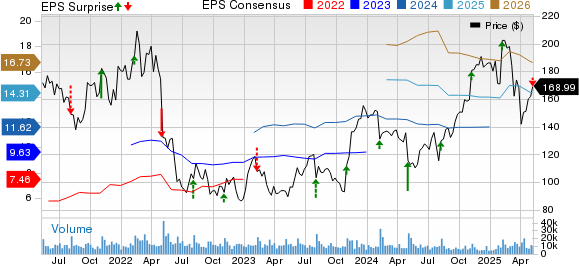

Expedia Group, Inc. Price, Consensus, and EPS Surprise

Expedia Group, Inc. price-consensus-eps-surprise-chart | Expedia Group, Inc. Quote

Gross Bookings Show Yearly Increase

Total gross bookings reached $31.5 billion, reflecting a 4% increase year over year. B2C gross bookings rose by 1%, while B2B gross bookings saw a more substantial 14% growth, attributed to the segment’s expanded international presence.

Lodging gross bookings increased by 5% year over year, totaling $23.03 billion. Hotel bookings alone climbed 6% due to strong performance from both B2B and Brand Expedia.

Booked room nights also demonstrated strength, rising 6% from the previous year’s quarter to reach 107.7 million.

Operating Performance Overview

Adjusted EBITDA for the quarter was $296 million, which is a 16.1% increase year over year.

Direct sales and marketing expenses amounted to $1.75 billion, up 6.5% year over year. Meanwhile, overhead expenses were reduced by 1.1% to $604 million.

Adjusted EBIT fell significantly, decreasing 65% year over year to a loss of $21 million.

Balance Sheet Highlights

As of March 31, 2025, the company reported cash and cash equivalents along with short-term investments totaling $6.1 billion, an increase from $4.5 billion as of December 31, 2024.

Long-term debt decreased to $4.465 billion from $5.223 billion as of December 31, 2024.

The gross leverage ratio remained stable at 2.1.

Net cash from operating activities was reported at $2.95 billion, while Expedia’s free cash flow amounted to $2.76 billion.

Positive Guidance for Q2 and 2025

For the second quarter of 2025, EXPE anticipates gross bookings to grow in the range of 2-4%, with revenue growth expected between 3-5%.

The company also forecasts first-quarter adjusted EBITDA margins to expand by 75-100 basis points year over year.

For the entirety of 2025, it expects gross bookings and revenue growth to be between 2% and 4%, alongside adjusted EBITDA margin expansion of 75-100 basis points year over year.

Zacks Ranking and Stock Comparisons

Currently, EXPE holds a Zacks Rank of #3 (Hold).

Some better-ranked stocks in the broader Zacks Retail-Wholesale sector include Alibaba (BABA), Costco Wholesale (COST), and Canada Goose (GOOS), each currently rated #2 (Buy).

Year-to-date, shares of Alibaba have risen by 48.4% and are set to report fourth-quarter fiscal 2025 results on May 15.

Costco shares have increased by 10% year to date, with third-quarter fiscal 2025 results scheduled for May 29.

Conversely, GOOS shares have decreased by 14% year to date, with fourth-quarter fiscal 2025 results expected on May 21.

Disclaimer

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.