Examining Wall Street’s Take on AudioEye: What Investors Should Know

Before investing in stocks, many investors rely on the insights of Wall Street analysts. Their recommendations—whether to Buy, Sell, or Hold—can significantly impact stock prices. But how much weight should you give these ratings?

Let’s analyze what analysts are saying about AudioEye (AEYE) and explore how investor opinions can align with brokerage insights.

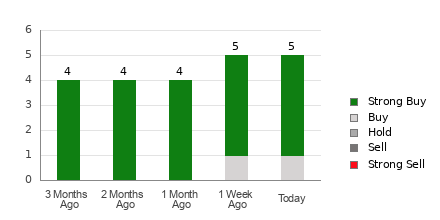

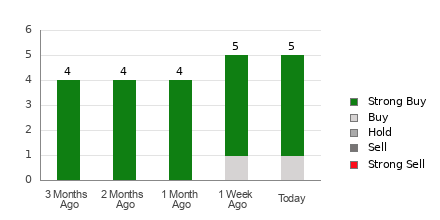

AudioEye has an average brokerage recommendation (ABR) of 1.20 on a scale from 1 to 5, where 1 is Strong Buy and 5 is Strong Sell. This figure is derived from the evaluations made by five brokerage firms, indicating a preference bordering on Strong Buy.

Of the five recommendations, four are classified as Strong Buy, while one is categorized as Buy. Thus, Strong Buy and Buy make up 80% and 20% of all assessments, respectively.

Evaluating AEYE’s Broker Recommendations

Explore AudioEye’s price target and stock forecast here>>>

While the ABR suggests a favorable outlook for AudioEye, relying solely on this rating may not be advisable. Various studies indicate that brokerage recommendations frequently fail to help investors identify stocks with strong price potential.

Why is this the case? Brokerage analysts often demonstrate a positive bias due to their firms’ interests in the stocks they cover. Our research highlights that there are five “Strong Buy” ratings for every “Strong Sell” rating issued by these firms.

This suggests that their recommendations may not always align with the actual market trajectory of a stock. Therefore, it is wise to use these insights to complement your own research rather than as the sole basis for investment decisions.

At Zacks, we provide a proprietary stock rating tool known as the Zacks Rank. This ranking system, which ranges from Zacks Rank #1 (Strong Buy) to #5 (Strong Sell), serves as a dependable indicator of stocks’ short-term price performance. Correlating the Zacks Rank with the ABR can enhance your investment strategy.

Understanding the Difference: ABR vs. Zacks Rank

Although both the ABR and Zacks Rank are scored from 1 to 5, they measure different factors.

The ABR relies exclusively on brokerage recommendations and can include decimal points (e.g., 1.28), whereas the Zacks Rank prioritizes earnings estimate revisions for its classification.

Brokerage analysts have historically been overly optimistic in their ratings due to their firms’ conflicts of interest, leading to more favorable ratings than warranted, which can misguide investors.

In contrast, the Zacks Rank emphasizes changes in earnings estimates, which consistently correlate with stock price movements. This model continuously updates its rankings based on current earnings prospects for various stocks, providing timely and relevant insights.

Should You Consider Investing in AEYE?

Currently, the Zacks Consensus Estimate for AudioEye remains unchanged at $0.52 for the current year. This stability among analysts regarding the company’s earnings potential suggests that the stock might likely perform in line with the broader market soon.

The modest shift in the consensus estimate, alongside other relevant earnings factors, positions AudioEye with a Zacks Rank of #3 (Hold). For more information, you can view today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

In summary, while the ABR for AudioEye carries a Buy-equivalent recommendation, it may be wise to approach this suggestion with caution.

Zacks Highlights a Top Semiconductor Stock

This newly recommended stock is notably smaller, at just 1/9,000th the size of NVIDIA, which has surged over 800% since our endorsement. Although NVIDIA remains a strong investment, our new top stock has considerably more room to grow.

With robust earnings growth and a broadening customer base, this semiconductor company is well-positioned to meet the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is predicted to skyrocket from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

AudioEye, Inc. (AEYE): Free Stock Analysis Report

To view this article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.