Wall Street Weighs In on Amazon: Is It a Smart Investment?

Investors often rely on Wall Street analysts’ recommendations when deciding whether to buy, sell, or hold a stock. However, the impact of these ratings on a stock’s price raises a question: How reliable are they?

Let’s take a look at how analysts currently view Amazon (AMZN).

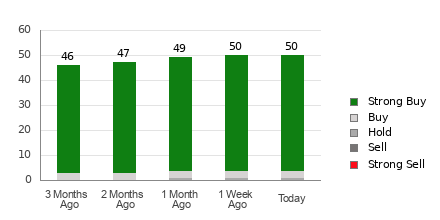

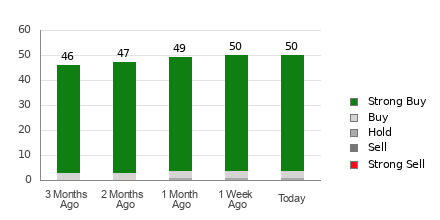

Amazon boasts an average brokerage recommendation (ABR) of 1.10, on a scale from 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This rating is based on the recommendations of 50 brokerage firms. An ABR of 1.10 suggests a consensus leaning between Strong Buy and Buy.

Of the total 50 recommendations that contribute to this ABR, 46 are classified as Strong Buy and three as Buy, making Strong Buy recommendations 92% and Buy recommendations 6% of all ratings.

Trends in Brokerage Recommendations for Amazon

For further insights on Amazon’s price target and stock forecast, check here>>>

Although the ABR indicates a positive outlook for Amazon, it’s crucial not to base investment decisions solely on these ratings. Research indicates that brokerage recommendations often don’t effectively lead investors toward stocks with the best price growth potential.

Why is this the case? Analysts typically display a strong positive bias due to the interests of the brokerage firms they represent. Our research shows that for every “Strong Sell” recommendation, there are five “Strong Buy” recommendations.

This situation indicates a misalignment between brokerage interests and those of retail investors, meaning that the ratings may not accurately reflect where a stock’s price is headed. As such, it may be more beneficial to use these recommendations to support your research or as a supplementary indicator.

Our Zacks Rank system, known for its trusted track record, categorizes stocks into five groups, spanning from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool can be a valuable asset in predicting a stock’s near-term price performance, especially when paired with the ABR.

Understanding the Difference: ABR vs. Zacks Rank

Although both the Zacks Rank and ABR are rated on a 1 to 5 scale, they measure different aspects.

The ABR is derived strictly from brokerage recommendations and often includes decimals (e.g., 1.28). In contrast, the Zacks Rank employs a quantitative model focused on earnings estimate revisions, presenting results as whole numbers ranging from 1 to 5.

Brokerage analysts have a history of being overly optimistic with their ratings. Their positions often result in issuing more favorable ratings than the available research supports, which can mislead investors.

Conversely, earnings estimate revisions form the core of the Zacks Rank. Studies have shown a strong correlation between these revisions and short-term stock price movements.

Additionally, the Zacks Rank is applied equally across all stocks with current-year earnings estimates from brokers, maintaining balance among its ranks.

Another key difference lies in the timeliness of the information. An ABR may not reflect the latest updates, whereas brokerage analysts regularly adjust earnings estimates. Thus, the Zacks Rank remains current in signaling future stock price movements.

Should You Invest in Amazon?

Recent revisions to earnings estimates for Amazon show an 8.4% increase in the Zacks Consensus Estimate for the current year, now set at $5.17.

This positive shift, backed by agreement among analysts on increasing EPS estimates, suggests that Amazon’s stock may have strong upward potential in the near term.

The magnitude of these changes in consensus estimates, along with other earnings-related factors, has earned Amazon a Zacks Rank #2 (Buy). A complete list of today’s Zacks Rank #1 (Strong Buy) stocks can be found here.>>>>

This Buy-equivalent ABR for Amazon could be useful for investors as they assess their options.

Exclusive Pick Could Surge by 100%

From a list of numerous stocks, five Zacks experts have each selected their top choice for substantial growth potential, with Director of Research Sheraz Mian highlighting one as having the best chance to double.

This company focuses on millennial and Gen Z consumers, bringing in nearly $1 billion in revenue last quarter alone. With its recent dip in price, now may be the optimal time to invest. While not all selections result in gains, this option has the potential to exceed previous Zacks’ picks like Nano-X Imaging, which skyrocketed by +129.6% in just over nine months.

Get our Top Stock and four additional options for free.

Catch up on the latest recommendations from Zacks Investment Research as you can download “5 Stocks Set to Double” today.>>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.