Analyzing Financial Insights: What Wall Street Analysts Think About Reddit Inc.

Investors frequently consider Wall Street analysts’ recommendations before deciding whether to Buy, Sell, or Hold a stock. While changes in ratings from these brokerage analysts can influence stock prices, are they truly significant?

Let’s examine the current insights from brokerage professionals regarding Reddit Inc. (RDDT) and evaluate the reliability of their recommendations.

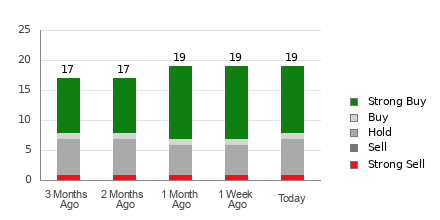

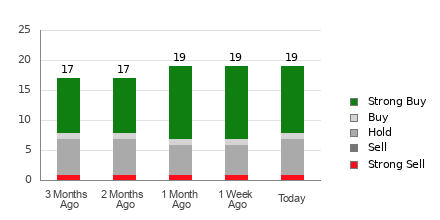

Reddit Inc. currently has an average brokerage recommendation (ABR) of 1.89 on a scale of 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This average is based on the recommendations from 19 different brokerage firms. An ABR of 1.89 falls between Strong Buy and Buy.

Out of the 19 total recommendations contributing to the ABR, 11 are classified as Strong Buy and one as Buy, which represent 57.9% and 5.3% of all suggestions, respectively.

Current Trends in Brokerage Recommendations for RDDT

View the price target & stock forecast for Reddit Inc. here>>>

While the ABR suggests a favorable outlook for Reddit Inc., relying solely on this figure may not be advisable. Research indicates that brokerage recommendations often fail to accurately predict stocks with high potential for price gains.

Why is this the case? Analysts from brokerage firms often show a favorable bias in their ratings due to the firms’ interests in the stocks they cover. Studies reveal that for every “Strong Sell” rating, there are five “Strong Buy” recommendations, suggesting a misalignment between brokerage interests and retail investors’ interests.

Consequently, while these recommendations can provide insight, they should primarily be used to support your own analysis or combine them with a reliable tool for predicting stock price movements.

Our firm’s proprietary stock rating tool, the Zacks Rank, has an established track record and evaluates stocks on a five-tier scale from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool offers a reliable indicator of short-term price performance, and aligning it with the ABR could enhance your investment strategies.

Understanding the Difference: ABR vs. Zacks Rank

Although both the ABR and Zacks Rank operate on a scale from 1 to 5, they represent different measures.

The ABR is derived entirely from brokerage recommendations and is typically shown with decimals (e.g., 1.28). Conversely, the Zacks Rank uses a quantitative model focused on earnings estimate revisions, represented in whole numbers from 1 to 5.

Brokerage analysts tend to be overly optimistic in their ratings due to their firms’ vested interests, often rating stocks more favorably than warranted, thereby misleading investors.

In contrast, the Zacks Rank centers around earnings estimate revisions. Historical data demonstrates a strong connection between earnings estimate trends and short-term stock price movements.

Further differentiating the two is the timing; ABR figures may not always reflect the latest information. Analysts continuously update earnings estimates based on new business trends, and these revisions are incorporated quickly into the Zacks Rank, making it a timely indicator of expected price movements.

Should You Invest in RDDT?

An analysis of earnings estimate revisions for Reddit Inc. shows that the Zacks Consensus Estimate for the current year has risen by 17.8% over the past month, now standing at -$3.45.

This rise in the consensus estimate reflects increasing optimism among analysts regarding the company’s earnings potential, suggesting that the stock might experience significant gains in the near future.

The magnitude of this recent change in estimates, combined with other relevant factors, has earned Reddit Inc. a Zacks Rank #2 (Buy). You can review the full list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Thus, the Buy-equivalent ABR for Reddit Inc. can be a useful point of reference for investors.

Expert Predicts “Best Pick to Double”

From an extensive selection of stocks, five Zacks experts have identified their top picks for potentially soaring over 100% in the coming months. Among these, Director of Research Sheraz Mian has selected one with the greatest explosive upside.

This company targets millennials and Gen Z, achieving nearly $1 billion in revenue last quarter. Recent price adjustments may offer an opportune time for investors to consider this stock. While past performance does not guarantee future success, previous Zacks recommendations have included stocks like Nano-X Imaging, which appreciated by +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Additional Picks

Reddit Inc. (RDDT): Access Your Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.