“`html

Navigating Market Momentum: Insights from Biotech to AI Opportunities

Last week, MarketWatch featured a bold declaration:

The bear market is coming – and it’s going to be painful.

While I see the merit in this view, I urge you not to sell your stocks just yet.

Let’s take a step back and look at the bigger picture.

Market Predictions: The Shift from 2022 to 2023

As 2022 gave way to 2023, predicting a recession became a common theme among economists. Most investors were still feeling the effects of the bear market experienced in 2022, leading to a wave of pessimism in the financial media.

Here are three headlines that reflect that sentiment:

- “Morgan Stanley’s Mike Wilson warns U.S. stocks could slump another 22% if recession arrives in 2023” – MarketWatch, January 2023

- “Tech Stocks and Layoffs Signal Trouble Ahead in 2023″ – Fortune, January 2023

- “Investors Brace for Stock Market Turmoil as Earnings Season Kicks Off” – Reuters, January 2023

Nevertheless, contrary to these gloomy forecasts, the stock market surged and has maintained an upward trajectory.

A cautious investor might argue:

“But Jeff, just because the market is up doesn’t mean the gains are justified. It could also mean we’re heading towards the 22% decline that Morgan Stanley predicted.”

This perspective holds some truth.

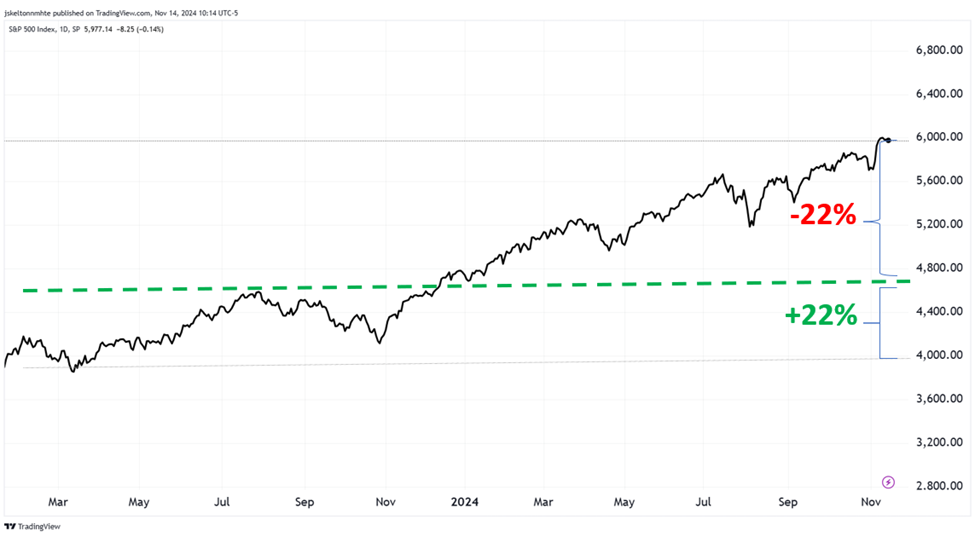

However, consider this: if the market were to drop by 22% tomorrow, how would that affect an investor who purchased the S&P on January 2, 2023?

They would still be up 22%.

This is not a mistake. Back on January 2, 2023, the S&P was trading around 3,824. A 22% increase would elevate its value to about 4,665 — precisely where the S&P would sit if it fell by that same 22% today.

Source: TradingView

This leads to a significant lesson from legendary investor Peter Lynch:

“Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.”

Bearish Sentiment in Context

While skepticism in January 2023 — and even today — can be justified, it’s important to recognize that market trends can defy logic. Bullish investor sentiment can propel prices higher, regardless of bearish forecasts.

We should not resist bullish momentum. Rather, we allow bearish insights to shape our strategies, including how much capital we invest and what safety measures we implement, while also being open to potential market rallies.

In light of this context, let’s explore some promising market opportunities identified by our experts.

Luke Lango, an analyst in our team, utilizes a strategy called “stage analysis” in his Breakout Trader service. His philosophy centers around the notion that essentially “price is truth.” He focuses on stocks exhibiting “Stage-2 breakouts,” which indicates bullish momentum.

Recently, Luke spotted significant strength in a few biotech and crypto trades. In his latest newsletter, he discussed several stocks that surged over 20% last week.

Out of respect for Breakout Trader subscribers, I can only share a couple of highlights (Please note these are not formal recommendations):

- Design Therapeutics: +24%

- VanEck Vectors Digital Transformation ETF: +49%

Congrats to the Breakout Trader participants on these impressive gains. However, the future looks even brighter, especially with the crypto sector gaining steam again. The biggest surge in interest hasn’t even begun yet.

On the biotech front, reduced interest rates could significantly propel the sector, with select small-cap biotechs poised for substantial growth.

But caution is warranted for those involved in pharmaceuticals. Macro expert Eric Fry warns:

Within the upcoming Trump administration, RFK, Jr. may be appointed to lead the Department of Health and Human Services, which introduces new uncertainties for the pharmaceutical industry.

This recommendation isn’t political; it’s based on clinical observations.

I can’t predict RFK, Jr.’s impact on healthcare outcomes. Nevertheless, his remarks before the election included:

“If you work for the FDA and are part of this corrupt system, I have two messages for you: 1. Preserve your records, and 2. Pack your bags.”

With this in mind, Eric advised subscribers of his Investment Report to close positions in Pfizer and the iShares Biotechnology ETF, IBB. This is more of a defensive strategy.

Returning to our discussion on strong trading momentum, where is Eric spotting potential trades today?

Water.

Finding Opportunities in the AI Landscape

Reflecting on our November 6 Digest, Eric noted:

“The internet may seem like a smooth, intangible force zipping data through the air, known as ‘the cloud’… However, this unseen force relies on countless physical servers operating continuously.”

“`

The Rising Costs of Water in Tech: What Investors Should Know

Millions of servers operate continuously in the world’s data centers, consuming vast amounts of electricity and water daily.

While the tech industry’s increasing energy use has drawn significant attention, its substantial water consumption hasn’t yet been fully acknowledged. As companies build more data centers globally, water consumption may soon pose both challenges and costs for them.

This insight backs one of Eric’s latest recommendations in Investment Report: Aris Water Solutions (ARIS).

There’s good news for investors: since Eric issued a buy alert on October 30, subscribers have seen a remarkable 56% increase as Aris’s stock is trading above his “buy up to” price of $21.25 today. Please refrain from purchasing this stock at current levels.

What factors are driving these impressive returns?

Eric provides some revealing details: Typically, a data center owned by Alphabet Inc. (GOOGL) consumes around 450,000 gallons of water daily. However, some of the latest facilities use ten times that amount, as do new semiconductor manufacturing plants.

For example, Taiwan Semiconductor Manufacturing Co. Ltd. (TSM) is constructing a cutting-edge chip facility in Arizona that will require 4.75 million gallons of water each day—enough to serve approximately 1.5 million average households.

It appears investors are starting to recognize these issues more clearly.

We seem to be just scratching the surface here. With artificial intelligence’s rising energy demands, water is becoming an increasingly precious resource.

Investing Strategies: Louis Navellier’s Short-Term Focus

For Louis Navellier, his focus isn’t on specific sectors but rather on identifying strong fundamentals wherever they exist.

If you’re unfamiliar with the Digest, Louis is a seasoned growth-stock investor with a remarkable four-decade-long investment history.

Louis pioneered the use of predictive algorithms to identify quantitatively strong stocks in the market. Forbes even characterized him as the “King of Quants.”

His investment strategy is centered around data. When his algorithms spot a promising opportunity, Louis assesses whether it’s suitable for his portfolios. Conversely, he also scrutinizes any signs of weakness, determining the best time to exit a position to avoid potential losses.

What has Louis recently added to his portfolio?

Recently, he and his subscribers from Accelerated Profits purchased Electromed (ELMD) on September 17, yielding a gain of 43.55% at the time of writing.

They then invested in Revolve Group (RVLV) a week later, which has increased by 28.47% since purchase.

The standout investment came when he introduced his subscribers to Sezzle, Inc. (SEZL) on September 3, resulting in a staggering 188% increase.

If you aren’t seeing such performance in your investments, Louis believes the market is becoming more favorable for finding these short-term winners. He has released a brief presentation on his strategy for identifying the next Sezzle. You can view his research here.

Market Outlook: Balancing Caution and Momentum

I remain cautious about today’s market primarily due to valuation issues.

However, I also recognize the bullish momentum that continues to influence the market.

In summary, while stocks may need a breather after recent gains, they are poised for profitability. It’s wise to prepare for potential changes in conditions, but for now, focus on sticking with what’s working—namely, capitalizing on bullish momentum.

Wishing you a pleasant evening,

Jeff Remsburg