Analyzing Wall Street Analysts’ Recommendations for AMD Stock

Investors frequently rely on Wall Street analysts’ recommendations before deciding whether to Buy, Sell, or Hold a stock. While media coverage of these rating shifts can influence a stock‘s price, their true impact merits closer examination.

To understand the reliability of brokerage recommendations, let’s explore the insights regarding Advanced Micro Devices (AMD).

Current Analyst Recommendations for AMD

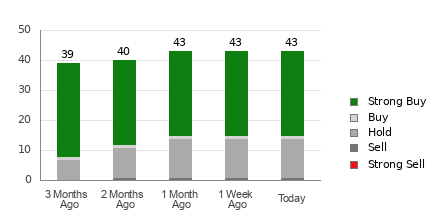

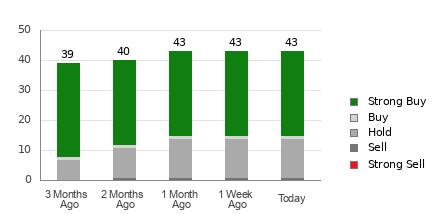

Advanced Micro Devices has an average brokerage recommendation (ABR) of 1.74, using a scale from 1 to 5 (Strong Buy to Strong Sell), based on assessments from 43 brokerage firms. This ABR indicates a leaning toward a Strong Buy.

Among the 43 recommendations underpinning the ABR, 27 are classified as Strong Buy, and one is a Buy, which means Strong Buy and Buy account for 62.8% and 2.3% of all advisories, respectively.

For further details on price targets and stock forecasts for Advanced Micro, click here>>>

Considerations for Using Brokerage Recommendations

Although the ABR suggests buying Advanced Micro, investors should not base decisions solely on this metric. Multiple studies indicate that brokerage recommendations often lack effectiveness in helping investors identify stocks with significant potential for price appreciation.

This disparity stems from the inherent conflicts of interest within brokerage firms. Analysts frequently exhibit a positive bias toward the stocks they cover. Research has shown that these firms typically issue five “Strong Buy” recommendations for every “Strong Sell.”

Consequently, brokerage recommendations may not accurately reflect a stock’s true price trajectory. Instead, they can serve as a complement to an investor’s own research or to corroborate indicators known for successfully predicting a stock‘s price movements.

The Value of Zacks Rank vs. ABR

Here, it is essential to distinguish between the Zacks Rank and the ABR. Although both are displayed in a 1-5 range, they represent different metrics.

The ABR derives from brokerage recommendations and is typically presented with decimals (e.g., 1.28). In contrast, the Zacks Rank relies on quantitative models that consider earnings estimate revisions, displayed solely in whole numbers from 1 to 5.

Historically, analysts at brokerage firms have skewed toward overly optimistic ratings. Because their compensation can be linked to performance, they frequently present overly favorable advisories that mislead investors.

On the other hand, Zacks Rank focuses on earnings estimate revisions, which research indicates correlates strongly with near-term stock price shifts.

Additionally, Zacks Rank applies different grades proportionately across all stocks analyzed, ensuring a balance among the five ranks assigned. Timeliness is another distinguishing characteristic; while the ABR doesn’t always reflect the latest data, Zacks Rank quickly adjusts to analysts’ evolving earnings estimates.

Current Investment Outlook for AMD

Looking specifically at the earnings estimates for Advanced Micro, the Zacks Consensus Estimate for this year remains steady at $4.59.

This unchanging consensus suggests that analysts’ views on the company’s earnings potential may expect performance in line with the broader market in the near term.

The current consensus estimate change, along with several other earnings-related factors, has resulted in a Zacks Rank of #3 (Hold) for AMD. For a comprehensive list of today’s Zacks Rank #1 (Strong Buy) stocks, click here >>>>

Thus, it may be prudent to exercise caution regarding the Buy-equivalent ABR for Advanced Micro.

Stock with High Growth Potential Identified by Zacks’ Research

Our experts have released a list of five stocks, each with a significant probability of gaining over 100% in the coming months. Among them, Director of Research Sheraz Mian highlights one stock poised for remarkable gains.

This standout company is recognized for its innovation, already serving over 50 million customers while offering a diverse suite of solutions. While not all Zacks picks succeed, this stock has the potential to surpass earlier notable winners, such as Nano-X Imaging, which increased by 129.6% in just over nine months.

For more insights, free reports, and details on our top stock, click here.

Advanced Micro Devices, Inc. (AMD): Get your free stock analysis report.

This article initially appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views expressed here belong to the author and do not necessarily represent those of Nasdaq, Inc.