Analyst Target Prices Indicate Potential Upside for MidCap ETF

In our analysis of ETFs at ETF Channel, we examined the trading prices of the underlying holdings against analysts’ 12-month target prices. This led us to calculate the weighted average target price for the Invesco S&P MidCap Low Volatility ETF (Symbol: XMLV), determining its implied analyst target price to be $68.52 per unit.

Currently, XMLV is trading at approximately $60.98 per unit. This suggests that analysts project a potential upside of 12.37% based on the average target prices of its holdings. Notably, three of XMLV’s holdings that exhibit significant upside to their target prices are Fidelity National Financial Inc (Symbol: FNF), Lamar Advertising Co (Symbol: LAMR), and American Financial Group Inc (Symbol: AFG).

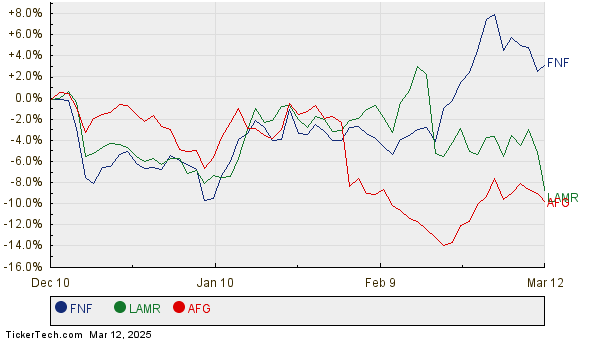

FNF, which has a recent share price of $62.03, has an average analyst target of $70.80, indicating a potential upside of 14.14%. Similarly, LAMR is valued at $116.76 with an average target price of $132.60, translating to a 13.57% upside. Analysts also expect AFG, currently priced at $125.25, to reach a target of $142.20 per share, reflecting a 13.53% potential increase. Below, we provide a twelve-month price history chart that compares the stock performance of FNF, LAMR, and AFG:

Here’s a summary table of the current analyst target prices mentioned:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P MidCap Low Volatility ETF | XMLV | $60.98 | $68.52 | 12.37% |

| Fidelity National Financial Inc | FNF | $62.03 | $70.80 | 14.14% |

| Lamar Advertising Co | LAMR | $116.76 | $132.60 | 13.57% |

| American Financial Group Inc | AFG | $125.25 | $142.20 | 13.53% |

Are analysts justified in their target predictions, or do they exhibit an overly optimistic outlook for these stocks in the next 12 months? Investors need to evaluate whether the analysts’ targets are backed by recent developments within the companies or industry trends. High price targets relative to trading prices may suggest positive sentiment but could also indicate potential downgrades if they are based on outdated assumptions. Such reflections warrant closer examination from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• Dividend Growth Stocks

• ETFs Holding ORAN

• MAYW Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.