Analysts Predict Strong Upside for JPMorgan US Momentum Factor ETF

In our detailed analysis of ETFs, ETF Channel evaluated the underlying holdings of the JPMorgan US Momentum Factor ETF (Symbol: JMOM). By comparing the trading prices of each holding with the average analyst 12-month forward target price, we calculated a weighted average implied target price of $69.26 per unit for JMOM.

Currently, JMOM is trading at approximately $55.76 per unit. This indicates a significant upside potential of 24.21%, based on the average targets from analysts for its underlying holdings. Notably, three of JMOM’s underlying assets show substantial upside against their respective analyst target prices: Procore Technologies Inc (Symbol: PCOR), Spotify Technology SA (Symbol: SPOT), and Spotify Technology SA (Symbol: SPOT), which appears to be mistakenly listed twice in the data.

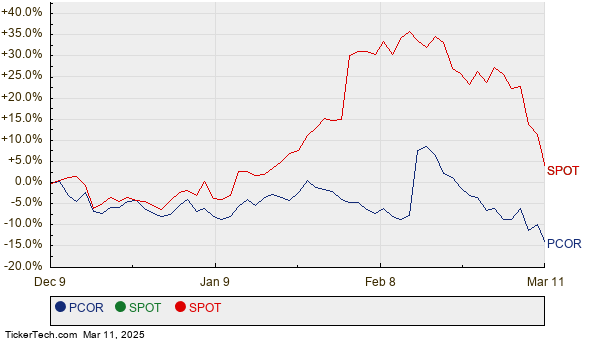

Procore Technologies (PCOR), priced at $69.18 per share recently, has an average analyst target price suggesting a potential increase of 31.62%, reaching $91.06 per share. For Spotify (SPOT), there is a 29.32% upside opportunity from its recent price of $489.24 to an anticipated target of $632.69 per share. Below is a twelve-month price history chart showing the stock performance of PCOR and SPOT:

Below is a summary table highlighting the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan US Momentum Factor ETF | JMOM | $55.76 | $69.26 | 24.21% |

| Procore Technologies Inc | PCOR | $69.18 | $91.06 | 31.62% |

| Spotify Technology SA | SPOT | $489.24 | $632.69 | 29.32% |

These analyst targets raise interesting questions: Are the estimates realistic, or do they reflect excessive optimism about potential future prices? Furthermore, have analysts properly accounted for the latest developments in the companies and the industry? A high target price that significantly exceeds a stock’s current trading price could indicate positive future expectations; however, it might also foreshadow potential downgrades if the targets are outdated. Investors are encouraged to conduct thorough research to explore these considerations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• My Morning Joe Stock Watch

• Funds Holding KRBN

• Institutional Holders of SBUX

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.