Fidelity Small-Mid Multifactor ETF Shows Potential for Growth

In our analysis at ETF Channel, we examined the underlying holdings of various ETFs. We compared the trading prices of these holdings against the average analyst 12-month forward target prices. For the Fidelity Small-Mid Multifactor ETF (Symbol: FSMD), the implied analyst target price is calculated to be $46.80 per unit.

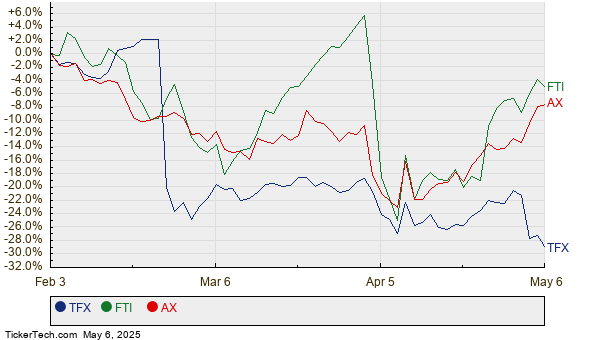

Currently, FSMD is trading around $39.16 per unit, indicating a potential upside of 19.51%. This forecast is based on the average analyst targets for the ETF’s underlying holdings. Noteworthy among these holdings are Teleflex Incorporated (Symbol: TFX), TechnipFMC plc (Symbol: FTI), and Axos Financial Inc. (Symbol: AX). Though TFX trades at a recent price of $122.90 per share, analysts project a target price 24.29% higher at $152.75 per share. Similarly, FTI shows a potential upside of 22.69% from its current price of $29.26 to an average target of $35.90. Meanwhile, AX is expected to rise to $82.83 per share, which is 22.41% above its current trading price of $67.67. Below is a 12-month price history chart comparing TFX, FTI, and AX:

Here’s a summary table of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity Small-Mid Multifactor ETF | FSMD | $39.16 | $46.80 | 19.51% |

| Teleflex Incorporated | TFX | $122.90 | $152.75 | 24.29% |

| TechnipFMC plc | FTI | $29.26 | $35.90 | 22.69% |

| Axos Financial Inc | AX | $67.67 | $82.83 | 22.41% |

As we consider these targets, it’s important to question whether analysts are being realistic or overly optimistic about these stocks’ future trading potential. A high target price relative to a stock’s current price may reflect confidence in future growth but could also prompt downgrades if targets are deemed outdated. These considerations warrant further research from investors.

![]() 10 ETFs With Most Upside to Analyst Targets »

10 ETFs With Most Upside to Analyst Targets »

Additional Insights:

• Healthcare Stocks Hedge Funds Are Buying

• MNRO YTD Return

• CHD MACD

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.