Analysts Project Significant Upside for SPDR S&P Bank ETF KBE

At ETF Channel, we analyzed the underlying holdings of various ETFs, focusing on the SPDR S&P Bank ETF (Symbol: KBE). Our findings indicate that the implied analyst target price for KBE, based on its holdings, is $62.82 per unit.

Currently, KBE is trading at approximately $47.42 per unit. This suggests that analysts believe there is a potential upside of 32.47% if their target prices for the underlying holdings are realized. Notably, three of KBE’s holdings exhibit considerable upside to their target prices: OFG Bancorp (Symbol: OFG), WSFS Financial Corp (Symbol: WSFS), and Lakeland Financial Corp (Symbol: LKFN).

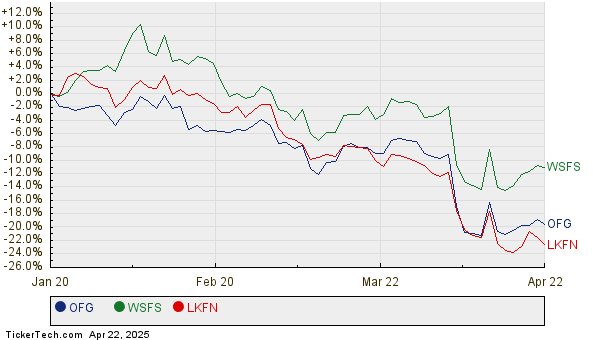

OFG Bancorp recently traded at $35.43 per share, while analysts have set an average target of $48.12 per share, representing a 35.83% increase. WSFS, on the other hand, has a recent share price of $47.67, with a target price of $63.60, indicating a potential 33.42% upside. Similarly, analysts expect LKFN’s target price to reach $69.20 per share, which is 32.77% higher than its recent trading price of $52.12. A comparison of the twelve-month price history for OFG, WSFS, and LKFN is shown below:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P Bank ETF | KBE | $47.42 | $62.82 | 32.47% |

| OFG Bancorp | OFG | $35.43 | $48.12 | 35.83% |

| WSFS Financial Corp | WSFS | $47.67 | $63.60 | 33.42% |

| Lakeland Financial Corp | LKFN | $52.12 | $69.20 | 32.77% |

As investors consider these target prices, it’s essential to assess whether analysts are being realistic or overly optimistic about future trading values of these stocks. A higher target relative to a stock’s current price often signifies optimism about future performance; however, it can also lead to downgrades if the targets seem disconnected from recent developments in the companies or the industry. Investors should conduct thorough research to evaluate these forecasts.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

TGT Insider Buying

CYAN YTD Return

Illinois Tool Works YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.