Analysts Project Growth for Invesco PHLX Semiconductor ETF

Recent analysis reveals a potential upside for the Invesco PHLX Semiconductor ETF (Symbol: SOXQ) based on the underlying stocks it holds.

After comparing the trading prices of SOXQ’s holdings with the average 12-month analyst target prices, the implied target for the ETF stands at $47.62 per unit. Currently, SOXQ trades around $40.27, suggesting a significant upside of 18.25%. Key players driving this sentiment include Qorvo Inc (Symbol: QRVO), Advanced Micro Devices Inc (Symbol: AMD), and Skyworks Solutions Inc (Symbol: SWKS).

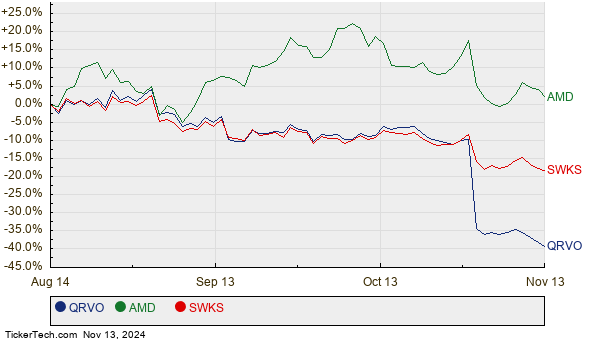

For instance, although QRVO recently traded at $67.28 per share, analysts have set a higher average target of $94.44, indicating a 40.36% upside. AMD, currently priced at $143.62, could climb 32.86% if it meets the analyst target of $190.81. Meanwhile, SWKS, trading at $87.04, shows a potential rise of 28.47% to reach its target price of $111.82. Below is a 12-month price history chart comparing the stock performance of QRVO, AMD, and SWKS:

Combined, these three companies represent 9.45% of the Invesco PHLX Semiconductor ETF. The following table summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco PHLX Semiconductor ETF | SOXQ | $40.27 | $47.62 | 18.25% |

| Qorvo Inc | QRVO | $67.28 | $94.44 | 40.36% |

| Advanced Micro Devices Inc | AMD | $143.62 | $190.81 | 32.86% |

| Skyworks Solutions Inc | SWKS | $87.04 | $111.82 | 28.47% |

These projections raise important questions: Are the analysts’ targets realistic, or do they reflect overly optimistic expectations? Investors should consider recent developments within these companies and the broader industry to better evaluate these predictions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Top Ten Hedge Funds Holding WULF

Institutional Holders of CUZ

BY Stock Predictions

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.