Analysts Project Significant Upside for iShares U.S. Medical Devices ETF

In our examination of the ETFs in the coverage universe at ETF Channel, we analyzed the trading prices of each holding relative to their average analyst 12-month forward target prices. This research led to the calculation of a weighted average implied analyst target price for the iShares U.S. Medical Devices ETF (Symbol: IHI), which stands at $69.31 per unit.

Current Trading Price and Analyst Expectations

As of now, IHI is trading at approximately $60.88 per unit. This indicates that analysts anticipate a potential upside of 13.84% based on the average targets of the underlying holdings. Notably, three of IHI’s key holdings present substantial upside potential compared to their analyst target prices: Enovis Corp (Symbol: ENOV), Treace Medical Concepts Inc (Symbol: TMCI), and LivaNova PLC (Symbol: LIVN).

Individual Stock Analysis

For Enovis Corp, which is currently priced at $32.37 per share, the average analyst target is significantly higher at $60.00 per share, suggesting an upside of 85.36%. Similarly, Treace Medical Concepts Inc has a recent share price of $6.10, with an analyst target of $9.73, indicating 59.48% upside potential. Meanwhile, analysts expect LivaNova PLC to reach a target price of $63.00 per share, which represents a 45.90% increase from its recent price of $43.18.

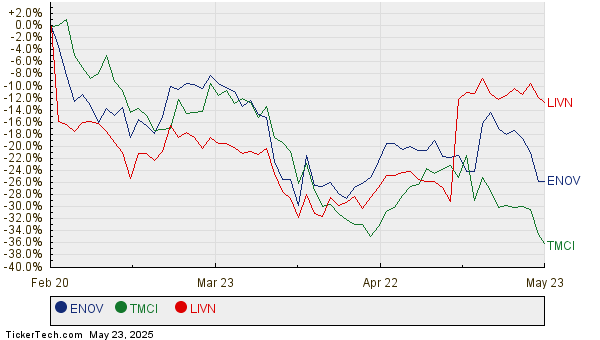

Price Performance Overview

Below is a twelve-month price history chart that compares the stock performance of ENOV, TMCI, and LIVN:

Analyst Target Price Summary

The current analyst target prices are summarized in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Medical Devices ETF | IHI | $60.88 | $69.31 | 13.84% |

| Enovis Corp | ENOV | $32.37 | $60.00 | 85.36% |

| Treace Medical Concepts Inc | TMCI | $6.10 | $9.73 | 59.48% |

| LivaNova PLC | LIVN | $43.18 | $63.00 | 45.90% |

Considerations for Investors

The validity of these analyst targets raises important questions. Are these projections justified, or do they reflect excessive optimism regarding future stock performance? Investors should consider whether analysts are aligned with recent developments within these companies and their respective industries. A significant target price above the current trading price may suggest optimism, but it can also precede potential downgrades if market conditions change. As always, further research is advisable for investors seeking clarity.

![]() 10 ETFs With Most Upside to Analyst Targets »

10 ETFs With Most Upside to Analyst Targets »

Additional Resources:

• The Ten Best ETF Performers

• O Dividend History

• TTNP Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.