“`html

The Real Estate Select Sector SPDR Fund ETF (Symbol: XLRE) has an implied analyst target price of $47.06 per unit, indicating a potential upside of 10.09% from its recent trading price of $42.75. This analysis was based on the weighted average of the 12-month forward target prices of its underlying holdings.

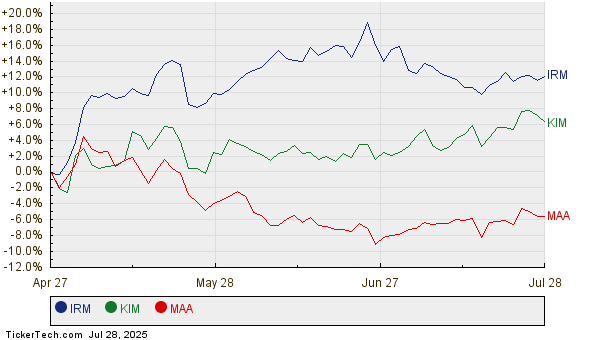

Notable underlying holdings include Iron Mountain Inc (IRM), with a recent price of $99.34 and an average target of $115.78 (16.55% upside), Kimco Realty Corp (KIM), currently trading at $21.78 with a target of $24.32 (11.67% upside), and Mid-America Apartment Communities Inc (MAA), priced at $151.65, expected to reach $167.04 (10.15% upside). Combined, these stocks represent 5.56% of XLRE.

Investors are encouraged to scrutinize whether analysts’ optimistic targets are justified in light of current market conditions and company performance.

“`