Intel’s Struggles Highlighted in Recent Earnings Report

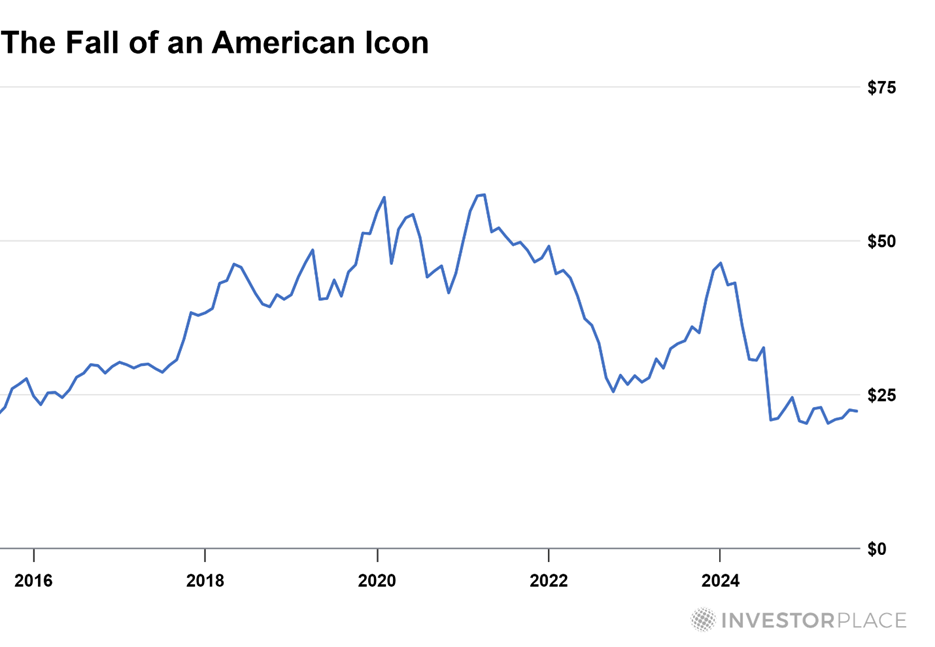

Intel Corporation (NASDAQ: INTC) has experienced a 26% decline in stock value over the past decade, amid significant gains by its semiconductor peers. Recently, new CEO Lip-Bu Tan initiated a restructuring effort, resulting in the layoff of 15% of the workforce, and the spin-off of its networking and edge business. The company has shifted its focus towards artificial intelligence (AI) and the x86 CPU franchise as part of its core strategy.

A Competitive Landscape

As Intel struggles, Advanced Micro Devices (NASDAQ: AMD) reported a 36% revenue increase to $7.44 billion in Q1, outperforming Intel despite a 3% revenue decline in Intel’s client segment, which brought in $7.9 billion. Meanwhile, Taiwan Semiconductor Manufacturing Company (NYSE: TSM) reported 44.4% revenue growth in Q2, reaching $30.1 billion, bolstered by high-margin advanced chip production.