Corbus Pharmaceuticals: Analyzing Potential Upside in Stock Valuations

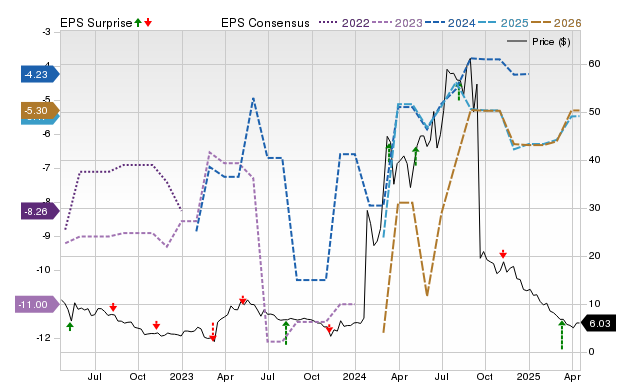

Corbus Pharmaceuticals (CRBP) concluded the most recent trading session at $6.03, reflecting a modest 0.5% increase over the last month. However, significant upside may remain if short-term price targets from Wall Street analysts are taken into consideration. The consensus price target of $52.11 suggests an impressive upside potential of 764.2%.

This mean price target is based on nine short-term estimates, with a standard deviation of $12.31. The lowest target is set at $35, indicating a 480.4% growth from the current price, while the highest estimate projects a surge of 1110.6% to reach $73. Notably, the standard deviation here is crucial, as it highlights the variation among analysts’ estimates; a smaller standard deviation indicates stronger consensus.

Understanding Price Targets and Their Reliability

While price targets are a widely followed indicator among investors, relying solely on them for investment decisions may prove unwise. The impartiality and accuracy of analysts when setting those targets is often questioned.

For CRBP, however, a compelling average target is not the only signal of potential growth. Analysts show strong agreement regarding the company’s prospects for reporting higher earnings, which bolsters the optimistic outlook. Although upward revisions in earnings estimates do not predict exact stock price movements, they have historically correlated well with future upside potential.

Price, Consensus, and EPS Surprise

Analysis of Analysts’ Price Targets

Research from various universities suggests that price targets are often misleading and may not provide clear direction for a stock’s actual trajectory. Studies reveal that analysts frequently set overly optimistic targets, which do not always reflect realistic outcomes.

These inflated targets can stem from business relationships that analysts’ firms maintain with the companies they cover. As such, analysts’ incentives might bias their projections.

Nevertheless, a tighter clustering of price targets, indicated by lower standard deviation, means that analysts have a more uniform outlook on the stock’s price direction and magnitude. This could provide a foundational basis for further research into the stock’s underlying fundamentals.

Ultimately, while price targets should not be completely disregarded, relying solely on them for investment decisions could lead to disappointing returns. As such, skepticism toward price targets is essential.

Prospective Upside in CRBP

Heightened analyst optimism regarding the company’s earnings outlook, evidenced by a consensus in raising EPS estimates, could indicate genuine upside potential in the stock. Historical data shows a strong link between earnings estimate revisions trends and subsequent stock price changes.

Over the past month, the Zacks Consensus Estimate for the current year has risen by 0.1%, as one analyst increased their estimate while none made downward revisions.

Additionally, CRBP holds a Zacks Rank #2 (Buy), placing it in the top 20% of over 4,000 stocks ranked by four crucial earnings estimate factors. Given its solid track record, this rank supports the contention of noteworthy potential upside for the stock in the near term. For a complete list of Zacks Rank #1 (Strong Buy) stocks, you can see them here.

In summary, while the consensus price target may not serve as an accurate gauge for CRBP’s growth, the implied direction of the price movement appears promising.

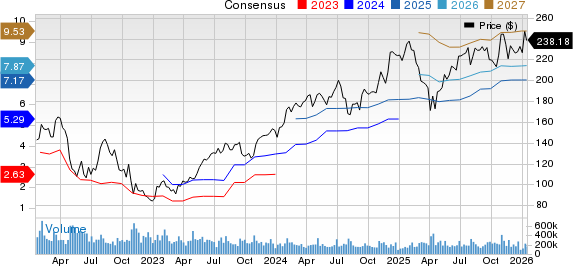

Zacks Highlights Top Semiconductor Stock

This semiconductor stock is significantly smaller than NVIDIA, which has seen a remarkable increase of over 800% since our recommendation. The new top chip stock is well-positioned to leverage the growing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to grow from $452 billion in 2021 to $803 billion by 2028.

To find out more about this promising stock, see it for free now.

Looking for the latest investment insights? Download our report on the 7 Best Stocks for the Next 30 Days for free here.

Corbus Pharmaceuticals Holdings, Inc. (CRBP): For a free stock analysis report, click here.

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.