The Dimensional US Real Estate ETF (DFAR) currently trades at $23.52 per unit, with analysts predicting a 12-month target price of $26.44, indicating a potential upside of 12.42%. The analysis was performed by comparing the ETF’s holdings against average analyst target prices.

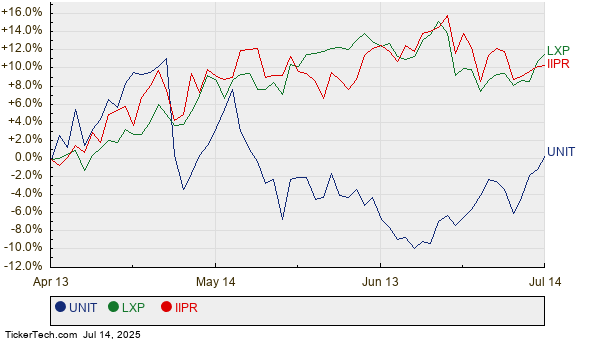

Among DFAR’s underlying holdings, Uniti Group Inc (UNIT) has a target price of $6.05, representing a 33.55% upside from its recent price of $4.53. LXP Industrial Trust (LXP) trades at $8.59 with a target of $10.50 (22.24% upside), while Innovative Industrial Properties Inc (IIPR) recently trades at $56.11, with a target price of $67.75, suggesting a 20.74% upside.

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Dimensional US Real Estate ETF | DFAR | $23.52 | $26.44 | 12.42% |

| Uniti Group Inc | UNIT | $4.53 | $6.05 | 33.55% |

| LXP Industrial Trust | LXP | $8.59 | $10.50 | 22.24% |

| Innovative Industrial Properties Inc | IIPR | $56.11 | $67.75 | 20.74% |