“`html

Exploring the Growth of ETFs Integrated with Options Strategies

Exchange-traded funds (ETFs) offer an efficient way to access various asset classes. Recently, there has been a notable rise in the popularity of options. Today, we will examine ETFs that incorporate options, a segment that is expanding within the ETF market.

Unique Returns from ETFs Incorporating Options

Options function differently from equities. They have expiration dates, which can lead to unpredictable returns. The returns from options are often not linear because options can:

- Be held individually (single leg).

- Be combined with other options (multi-leg).

- Be combined with underlying equity exposures (overlay).

Investors can craft portfolios using options that yield varied payoffs, such as generating extra income or providing downside protection.

Growth of ETFs with Options

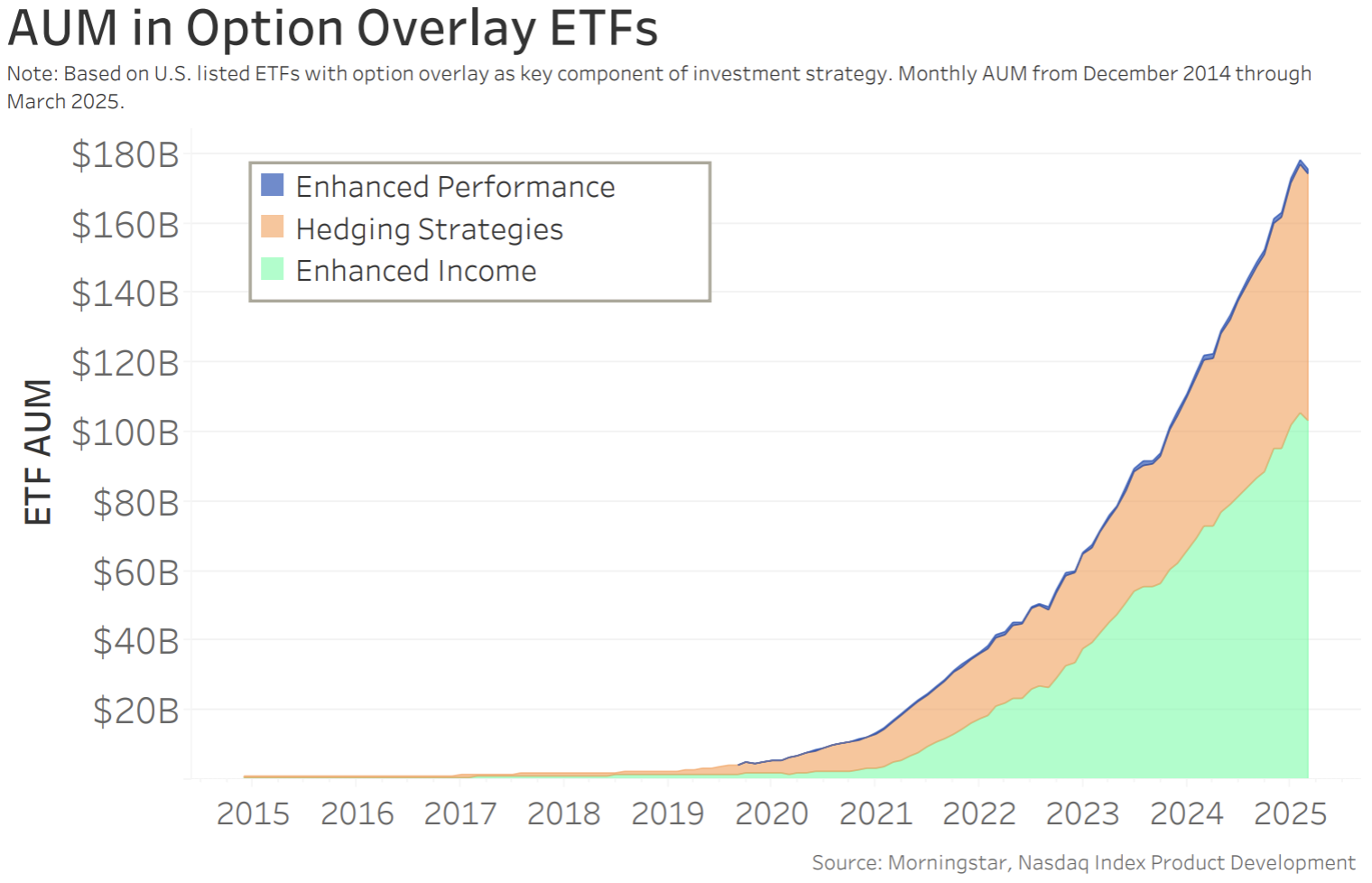

According to data, assets in option overlay ETFs have seen substantial growth since 2020, a period marked by a significant market downturn due to the COVID-19 pandemic. Prior to 2020, total assets under management (AUM) in this area were about $5 billion. Today, these strategies account for over $160 billion, with most assets focused on either enhanced income or hedging strategies.

Chart 1: Assets in option overlay ETFs

Additionally, option overlay funds have constituted roughly 20% to 30% of new equity ETF launches since 2019.

Chart 2: Option overlay ETF launches

Popular Option Overlay Strategies

Various option overlay strategies serve different purposes. These options are systematically combined to achieve targeted outcomes. In Chart 3, we categorize funds based on Nasdaq’s in-house fund taxonomy:

- Enhanced Income Strategies (Green): These primarily focus on boosting income. This is achieved through writing options for premium income alongside long equity exposure (e.g., covered calls like QYLD or put-writes like WTPI).

- Hedging Strategies (Orange): These strategies aim to protect against downside risk while allowing for some upside participation, typically using long put options and short call options (e.g., traditional buffer funds like PDEC and FNOV, or full downside protection funds like TJUL).

- Enhanced Performance (Blue): These seek to outperform a benchmark by increasing income (e.g., OVL or SPYC).

As of March 2025, there are over 430 equity ETFs with options, collectively managing over $160 billion. Most of these assets fall under income and hedging strategies.

Chart 3: Option overlay ETFs by strategic focus

Understanding the Mechanics

Each overlay strategy typically involves a mix of long and short positions in call and put options, resulting in varied outcomes. The visuals below illustrate how the interaction between stock exposure and options affects portfolio return profiles, which are not linear.

Chart 4: Hypothetical payoffs of different types of option overlays

The diagrams illustrate how popular overlay strategies function. Note that there is often a trade-off in the returns produced: returns can occasionally surpass or fall below traditional stock returns.

The benefits of each strategy vary:

- Covered Call: Generates income while offering limited upside.

- Protective Put: Provides full downside protection while allowing participation in upside gains.

“`# Understanding Buffer Funds and Option Strategies in Today’s Market

- Traditional buffer fund – provides downside protection up to a certain limit while allowing some upside equity participation.

- 100% downside protection (or collars) – similar to traditional buffer funds, but offers full downside protection.

Exploring Covered Calls and Protective Puts

The first option-overlay ETF in the U.S. market, the Invesco S&P 500 Buy/Write ETF (PBP), employs a covered call strategy on the S&P 500.

A covered call typically consists of two components:

- Long equity exposure – The position value changes directly in line with the stock price.

- Short call option – Holding the position to expiration means if the stock price is below the strike price, the position retains the premium. If above, the position’s value decreases.

The premium gained from the short call allows the combined portfolio to potentially outperform a standard stock fund. Still, as stock prices decline, this combined exposure may decline too. Should the short call go “in the money,” any payouts are balanced by gains from the stock, capping upside potential at the strike price.

A protective put functions as insurance against a stock portfolio’s decline below the strike price. This approach maintains upside exposure, but the cost of the option (premium) usually brings down returns compared to a simple long stock position.

Chart 5: Long Equity + Single Option

Overall, around 70 types of U.S. funds apply covered call strategies, managing almost $90 billion in total assets.

Diving Deeper into Buffer Strategies

Buffer strategies are relatively complex, incorporating multiple layers of options to offer downside protection along with some upside capture.

Four key components typically characterize a traditional buffer strategy. Chart 6 illustrates the sequential steps involved:

- Establish Equity Exposure: This can be done by going long the index or purchasing a deep in-the-money call option.

- Set the Cap: By selling an out-of-the-money call option, the strategy’s upside potential is capped.

- Long Put Option: Defines the start of the downside buffer.

- Short Put Option: This establishes the end of the buffer and aids in funding the downside protection.

Chart 6: How to Create a Buffer

Chart 6 also highlights the expected payoff profile when combining these components, although actual outcomes may vary based on factors like when investors enter or exit the strategy compared to the defined outcome period.

A key consideration is the trade-off between upside potential and downside protection. While a buffer strategy can yield returns up to the set cap, exceeding this will lead to underperformance. However, investors may find buffer strategies appealing for their ability to limit downside risk at a lower cost than simply purchasing a put option, leveraging additional premium from other options in the mix.

Historically, buffer strategies have shown to perform better than underlying benchmarks during market downturns. For instance, Chart 7 portrays the rolling drawdown of various buffer strategies from 2020 to the present, showing reduced risk compared to a basic stock portfolio.

Chart 7: Rolling Drawdown of Buffer Funds

Who Manages These ETFs?

A significant portion of assets is handled by a few leading ETF issuers.

- J.P. Morgan: The largest issuer, managing about $65 billion, including the two top ETFs, JEPQ and JEPI.

- First Trust and Innovator ETFs: Both organizations focus more on downside-protected strategies.

- Global X, Amplify, and Neos: Though they offer fewer ETFs, they have some of the most in-demand options-based ETFs, such as QYLD, XYLD, DIVO, and SPYI.

Chart 8: Top ETF Issuers of Option Overlays

Importance of Option Strategies

Option strategies can be customized to achieve various defined outcomes, making ETFs with options accessible for investors seeking more complex strategies.

Nonetheless, due to their intricacy, these strategies may not suit all investors. Understanding what is being purchased is crucial to avoid unwanted results.

In summary, option overlay strategies reflect the evolution of the U.S. financial markets.