Berkshire Hathaway Inc. (ticker: BRK.B) reported an increase in its float, growing from approximately $114 billion at the end of 2017 to $173 billion by the end of Q1 2025. This float, derived from insurance premiums, represents a significant low-cost capital source, constituting about one-quarter of the company’s total revenues, driven by businesses such as GEICO, General Re, and Berkshire Hathaway Reinsurance Group.

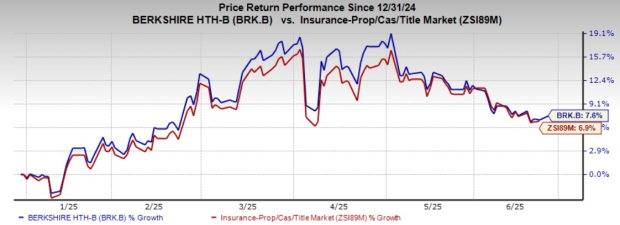

Year-to-date, shares of BRK.B have gained 7.6%, outperforming the industry. However, it trades at a price-to-book value ratio of 1.59, slightly above the industry average of 1.55. The Zacks Consensus Estimates for BRK.B’s second and third-quarter EPS for 2025 have decreased by 3% and 0.3%, respectively, although the full-year 2025 EPS forecast has increased by 0.2%.

As of 2025, the company expects revenue growth, with year-over-year increases projected for both 2025 and 2026, indicating upward potential in the long term.