Investors Eye Growth Opportunities in Big Tech as Markets Surge

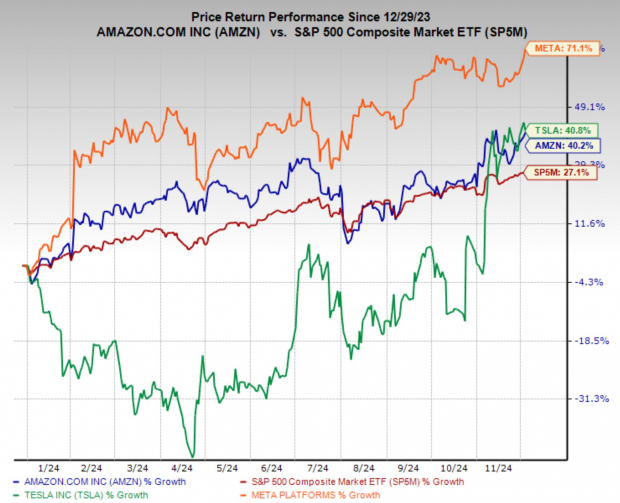

As the stock market continues its impressive rise into the end of the year, investors are uncovering lucrative possibilities within some of the largest and most recognizable companies. Amazon (AMZN), Meta Platforms (META), and Tesla (TSLA—three giants of the modern market—are not only leading the way this year, but they also seem set to keep outperforming. Strong earnings growth forecasts, impressive Zacks Ranks, and attractive technical setups enhance their positive outlook.

This article explores why these three members of the Magnificent Seven stand out and why they may be wise investments for those looking for both growth and momentum.

Image Source: Zacks Investment Research

Meta Platforms (META): Strong Valuation and Breakout Potential

Meta Platforms has gained significant attention this year, driven by its commitment to profitability and innovation. After a phase of substantial investment in the metaverse, Meta has shifted its focus toward efficiency, a change that has fostered investor confidence.

Why Meta is an Attractive Option:

- Valuation: Despite its recent gains, Meta is still considered well-priced compared to its tech counterparts. Currently, it trades at a one-year forward earnings multiple of 26.1x, which is reasonable for a rapidly growing and profitable firm.

- Earnings Growth: Meta holds a Zacks Rank #2 (Buy) due to optimistic earnings growth projections. Analysts expect revenues and profits to expand, with earnings projected to increase by around 20% annually over the next three to five years.

- Technical Setup: Meta’s stock is currently undergoing a significant technical breakout, indicating strong chart performance after a period of consolidation.

For those looking for a blend of growth and value, Meta presents an intriguing opportunity, especially as it approaches historical highs.

Image Source: TradingView

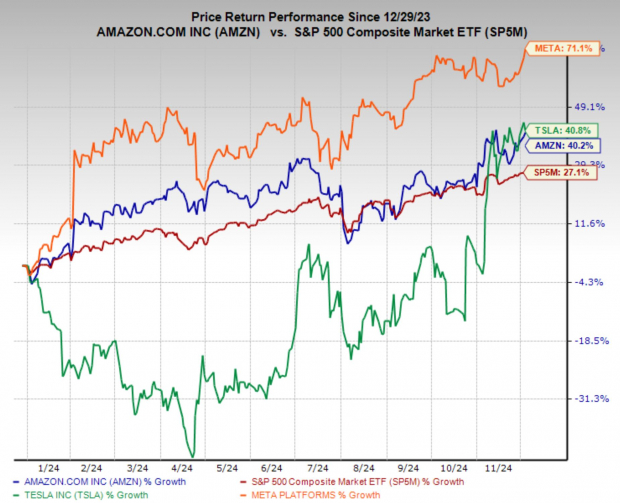

Amazon (AMZN): Growth Fueled by AWS Reacceleration

Amazon is back in the spotlight as a market leader, thanks to improvements in the macroeconomic landscape and a rebound in its Amazon Web Services (AWS) division. Despite its enormous size, Amazon has shown remarkable adaptability to shifting consumer and business demands, allowing it to sustain its leadership in both e-commerce and cloud services.

Key Drivers for Amazon:

- Valuation: Amazon is currently viewed as historically undervalued considering its growth prospects. It trades at a one-year forward earnings multiple of 40x, among the most favorable valuations in its history.

- Earnings Momentum: With a Zacks Rank #2 (Buy), Amazon is experiencing upward adjustments to earnings forecasts as analysts expect strong cloud performance and ongoing e-commerce efficiency improvements. EPS is anticipated to grow 28.9% annually, the highest estimate among the Magnificent Seven stocks.

- Technical Strength: Amazon’s stock is nearing all-time highs, and a breakout above these levels could lead to increased investor interest.

For long-term investors, Amazon offers a compelling mix of solid fundamentals and improving technical momentum, making it a noteworthy option for growth-focused portfolios.

Image Source: TradingView

Tesla (TSLA): A Remarkable Stock Rally

Tesla’s share price has been on a dramatic rise in 2024, propelled by Elon Musk’s growing influence. The stock is known for its cyclical nature—oscillating between substantial rallies and sharp corrections—and it is currently enjoying one of its notable bullish phases.

What Sets Tesla Apart:

- Leadership and Vision: Tesla remains a front-runner in the electric vehicle (EV) sector, driving considerable investor excitement. Elon Musk’s prominent role in technology and business only amplifies Tesla’s ability to attract attention and investment.

- Momentum: With a Zacks Rank #2 (Buy), Tesla showcases significant price momentum. Analysts expect earnings growth to continue as the company capitalizes on economies of scale alongside the expanding adoption of EVs worldwide.

Is Tesla Set for a Major Breakout?

In the world of stocks, Tesla is currently shaping a bullish flag pattern, which signals a potential upward movement. A successful breakout from this formation could allow the stock to revisit its record highs from 2022, signifying strong upside potential.

Image Source: Zacks Investment Research

What About Investing in TSLA, AMZN, and META?

For those looking for growth, investing in Tesla, Amazon, and Meta Platforms offers attractive prospects within the so-called Magnificent Seven. Each of these companies boasts promising earnings forecasts, appealing valuations, and robust technical positions, making them worthy of consideration.

Unbeatable Offer for Stock Picks

This is not a joke.

Years ago, we surprised our members with an offer: 30-day access to all our stock picks for just $1. There are no hidden fees or obligations.

Many have seized this opportunity. Some have hesitated, convinced there must be a catch. While there is a reason for this offer, we simply want you to explore our portfolio services, which include Surprise Trader, Stocks Under $10, Technology Innovators, and more. These services reported 228 positions yielding double- and triple-digit gains in 2023 alone.

Interested in the top recommendations from Zacks Investment Research? Download our free report on 5 Stocks Set to Double today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the complete article, visit Zacks.com.

Zacks Investment Research

The opinions expressed here are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.