Analysts Predict Significant Upside for iShares S&P Small-Cap 600 Value ETF

By examining the key holdings of the iShares S&P Small-Cap 600 Value ETF (Symbol: IJS), recent analysis shows promising growth potential based on analyst forecasts.

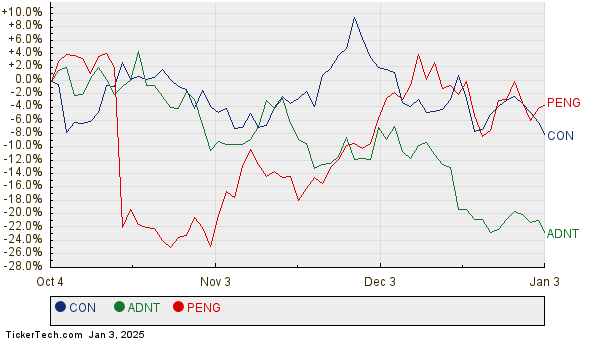

The current trading price of IJS stands at approximately $108.14 per unit. This price suggests that analysts anticipate an impressive 21.32% upside, projecting a target price of $131.20 per unit within the next 12 months. Among the top holdings contributing to this outlook are Concentra Group Holdings Parent Inc (Symbol: CON), Adient plc (Symbol: ADNT), and Penguin Solutions Inc (Symbol: PENG). For instance, CON, recently priced at $19.29 per share, has an average analyst target of $27.50, indicating a potential 42.56% increase. Furthermore, ADNT’s current price of $16.75 implies a 39.55% upside should it meet its target of $23.38. Similarly, PENG, trading at $19.32, is expected to increase by 25.08% to reach an analyst target of $24.17. Below is a chart detailing the performance of these companies over the past twelve months:

A summary of the analyst target prices for these stocks is presented in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares S&P Small-Cap 600 Value ETF | IJS | $108.14 | $131.20 | 21.32% |

| Concentra Group Holdings Parent Inc | CON | $19.29 | $27.50 | 42.56% |

| Adient plc | ADNT | $16.75 | $23.38 | 39.55% |

| Penguin Solutions Inc | PENG | $19.32 | $24.17 | 25.08% |

This raises an important question: Are analysts justified in their targets, or might they be overly optimistic about these stocks’ prospects in the coming year? It’s crucial for investors to consider whether analysts have sound reasons behind their price targets and to stay informed about any recent changes in company situations or industry dynamics. A higher target price can signal an optimistic view of the future but may also lead to lower targets if expectations do not match reality. Investors should conduct thorough research before making decisions.

![]() Explore 10 ETFs With Most Upside To Analyst Targets »

Explore 10 ETFs With Most Upside To Analyst Targets »

Also see:

• Communications Services Dividend Stocks

• NPAB YTD Return

• Institutional Holders of UCL

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.