New Apple Options Open for June 2027: A Closer Look

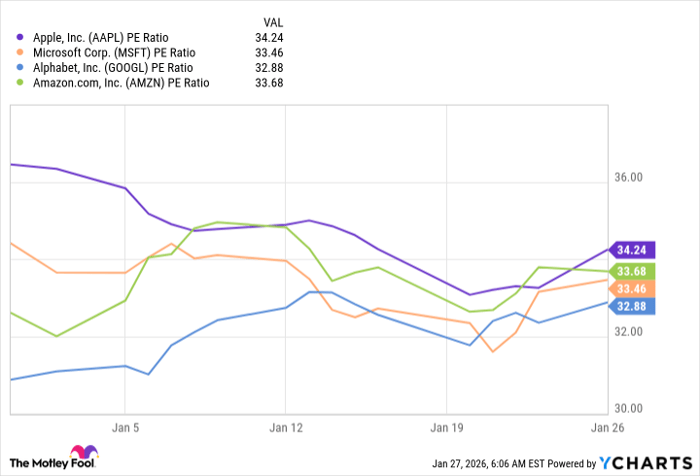

Investors in Apple Inc (Symbol: AAPL) have new options available for trading, set to expire in June 2027. With 871 days until expiration, these contracts may present a profitable opportunity for those interested in selling put or call options and potentially earning higher premiums compared to shorter-term contracts.

Exploring the Put Option

One intriguing option is the put contract with a $220.00 strike price, which has a current bid of $21.95. By selling this put contract, an investor agrees to purchase Apple shares at $220.00 while collecting the premium. This situation effectively lowers the cost basis to $198.05, significantly cheaper than the current share price of $225.79. For those looking to buy AAPL shares, this may provide a more appealing entry point.

The $220.00 strike price reflects a roughly 3% discount from the current trading price, making it out-of-the-money by that percentage. According to current analytics, there is a 69% likelihood that this put contract could expire worthless. Should it do so, the premium would yield a 9.98% return on the investment, equating to 4.18% annualized — a benefit we refer to as the YieldBoost.

Below is a chart illustrating Apple Inc.’s trading history over the past twelve months, emphasizing the position of the $220.00 strike price:

Analyzing the Call Option

On the calls side, the contract at a $260.00 strike price currently has a bid of $26.05. If an investor buys AAPL at the current price of $225.79 and then sells this covered call, they commit to sell the stock at $260.00. Taking into account the premium, this could provide a total return of 26.69% if the shares are called away at the June 2027 expiration. However, if AAPL significantly rises, the investor may miss out on potential gains, underscoring the importance of examining both price trends and company fundamentals.

Below is a chart showing AAPL’s trading history, featuring the $260.00 strike price highlighted:

The $260.00 strike price indicates a 15% premium over the current trading value. This means that there is also a chance the covered call contract could expire worthless, allowing the investor to retain both their shares and the premium. Currently, there is a 48% chance of this happening. If the covered call expires without being exercised, it adds an extra return of 11.54% to the investor, or 4.84% annualized—also known as the YieldBoost.

For this put contract, implied volatility stands at 27%, while the call contract shows 24%. On the other hand, actual trailing twelve-month volatility—considering the last 249 trading days and today’s price of $225.79—is calculated at 23%. To explore more options and investment strategies, please visit StockOptionsChannel.com.

![]() Top YieldBoost Calls of the Nasdaq 100 »

Top YieldBoost Calls of the Nasdaq 100 »

Also see:

- SISI market cap history

- CBSH market cap history

- INNV shares outstanding history

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.