Analysts See Upside for iShares Russell Mid-Cap Growth ETF (IWP)

We analyzed the underlying holdings of ETFs in our coverage at ETF Channel. By comparing the trading price of each holding with the average analyst 12-month forward target price, we calculated the weighted average implied analyst target price for the iShares Russell Mid-Cap Growth ETF (Symbol: IWP). Currently, the implied target price for IWP stands at $144.41 per unit.

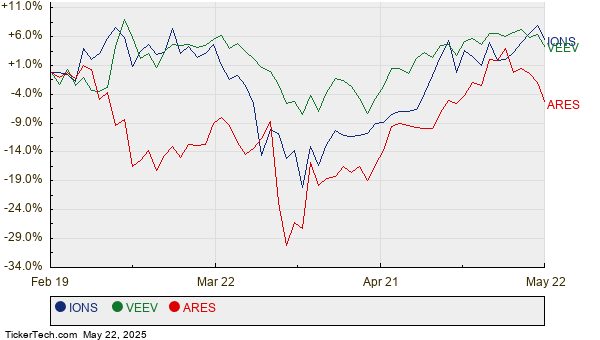

With IWP trading at approximately $130.58 per unit, analysts anticipate a 10.59% increase based on the average target prices of the ETF’s underlying holdings. Noteworthy among these holdings are Ionis Pharmaceuticals Inc (Symbol: IONS), Veeva Systems Inc (Symbol: VEEV), and Ares Management Corp (Symbol: ARES), each demonstrating significant upside potential. Ionis shares currently trade at $33.50 but have an average target of $56.86, reflecting a 69.74% upside. Similarly, Veeva shares at $235.00 indicate a 12.23% upside toward an average target of $263.73. Analysts forecast a 10.67% increase for Ares, with a target of $175.94 against a current price of $158.98. Below is a twelve-month price history chart comparing the stock performances of IONS, VEEV, and ARES:

The following summary table outlines the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell Mid-Cap Growth ETF | IWP | $130.58 | $144.41 | 10.59% |

| Ionis Pharmaceuticals Inc | IONS | $33.50 | $56.86 | 69.74% |

| Veeva Systems Inc | VEEV | $235.00 | $263.73 | 12.23% |

| Ares Management Corp | ARES | $158.98 | $175.94 | 10.67% |

These analyst targets prompt questions regarding their accuracy. Are analysts justified in their projections, or are they being overly optimistic about stock performance over the next twelve months? A significant target relative to a stock’s trading price may indicate optimism about future performance. However, it can also suggest potential downgrades if targets are based on outdated assumptions. Investors should conduct thorough research to evaluate these analyses.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.