“`html

Analyst Targets Suggest Room for Growth in LGLV ETF

Recent analysis by ETF Channel compares the trading prices of ETF holdings against the average analyst 12-month forward target prices. Specifically, for the SPDR SSGA US Large Cap Low Volatility Index ETF (Symbol: LGLV), the implied analyst target price based on its underlying holdings is $187.34 per unit.

Current Performance and Potential Upside

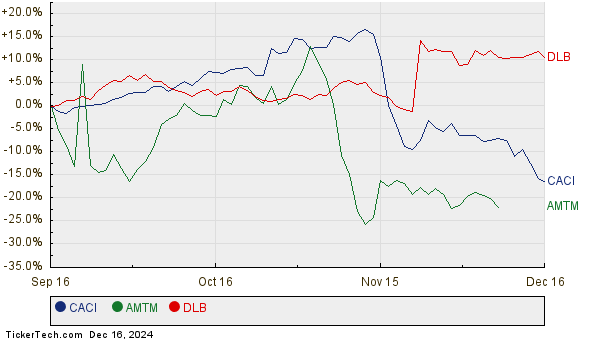

As LGLV is currently trading at approximately $170.94 per unit, analysts predict a potential upside of 9.59% based on the average target prices of the holdings within the ETF. Notably, three key holdings within LGLV show significant upside potential: CACI International Inc (Symbol: CACI), AMENTUM HOLDINGS INC (Symbol: AMTM), and Dolby Laboratories Inc (Symbol: DLB). CACI’s recent trading price is $409.91 per share, but analysts target $569.20 per share, indicating a 38.86% upside. AMTM, priced at $23.05, has a target of $30.50, reflecting a 32.32% potential increase. For DLB, analysts expect shares to rise to $100.00 from the current price of $79.18, suggesting a 26.29% upside. Below is a twelve-month price history chart comparing the performance of CACI, AMTM, and DLB:

Analyst Target Summary

Here’s a summary table of the current analyst target prices for the mentioned holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR SSGA US Large Cap Low Volatility Index ETF | LGLV | $170.94 | $187.34 | 9.59% |

| CACI International Inc | CACI | $409.91 | $569.20 | 38.86% |

| AMENTUM HOLDINGS INC | AMTM | $23.05 | $30.50 | 32.32% |

| Dolby Laboratories Inc | DLB | $79.18 | $100.00 | 26.29% |

Considerations for Investors

Investors may wonder if analysts’ targets are well-founded or overly optimistic. High target prices compared to a stock’s current trading price can indicate confidence in future growth. However, such targets may also require reevaluation based on the latest developments within the companies and the industry as a whole. These questions merit thorough research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Stocks Where Yields Got More Juicy

• Top 10 Hedge Funds Holding Equinix

• AQST Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`