Eli Lilly (LLY) has initiated a $1.2 billion acquisition of Ventyx Biosciences (VTYX) to enhance its portfolio in oral small-molecule therapies targeting inflammatory-mediated diseases. This deal marks the beginning of Eli Lilly’s M&A strategy for 2026, as it seeks to bolster its presence in various therapeutic areas beyond cardiometabolic health, including oncology and immunology. The acquisition is expected to close in the first half of 2026.

This move follows a proactive M&A approach throughout 2025, where Lilly completed several significant transactions, including the $2.5 billion acquisition of Scorpion Therapeutics and a $1 billion deal for SiteOne Therapeutics. Lilly aims to mitigate risks from relying on a single treatment market, especially as competition intensifies in the obesity sector with Novo Nordisk’s recent FDA approval for the first oral GLP-1 therapy, Wegovy.

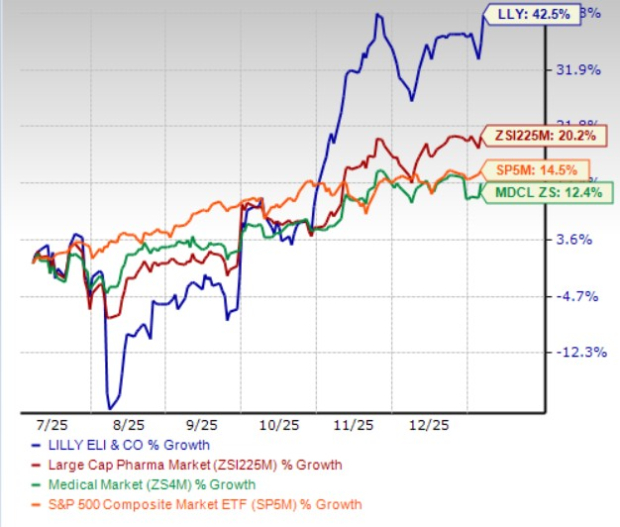

While Eli Lilly’s stock has risen 42.5% in the past six months, exceeding the industry’s 20.2% growth, the company is also evaluating its earnings potential, with updates suggesting a rise from $23.60 to $23.78 per share for 2025 and from $31.70 to $33.59 for 2026.