Michael Saylor’s Bold Bitcoin Vision: The Digital Gold Rush

Who is Michael Saylor?

Michael Saylor serves as the Executive Chairman of MicroStrategy (MSTR). He is known for making groundbreaking investments in Bitcoin, which he promotes as “digital gold.” Saylor strongly believes that Bitcoin outperforms traditional assets like gold.

The Impact of Saylor’s Bitcoin Strategy

Saylor has become a leading advocate for Bitcoin, helping MicroStrategy achieve billions in profits since adopting its Bitcoin investment strategy. His unwavering belief in Bitcoin’s potential has made him a significant figure in the cryptocurrency world.

“Those who can both be right and sit tight are uncommon.” ~ Jesse Livermore

Many may have differing opinions about Bitcoin, yet Saylor’s insights are valuable. His strong conviction in his investment thesis has consistently proven right. In a recent interview, he explained his long-term perspective on Bitcoin:

“We’re in the Bitcoin gold rush. It started in January of 2024, and it will run until about November of 2034. How many people know what will happen in November of 2034? In November of 2034, 99% of all the Bitcoin will have been mined, and the last 1% will come out over the next 100 years. So, for all practical purposes, the stock-to-flow ratio of Bitcoin is infinity, and in 2034, it becomes noise.”

“At the beginning of the gold rush, no bank could custody Bitcoin, no institutional investor could buy Bitcoin, no Wall Street trading firm. When those spot ETFs were approved, that created a fire or an avalanche. The genie is out of the bottle.”

“It doesn’t matter who’s elected president next, it doesn’t matter who is the head of the SEC. No politician’s opinion, no banker opinion, no regulator opinion, matters after that date. That kicked off the gold rush.”

Breaking It Down: Key Factors in Saylor’s Thesis

Bitcoin Scarcity, ETF Approval, & Institutional Adoption

Scarcity: There will only ever be 21 million Bitcoin. Unlike traditional currencies or commodities, Bitcoin has a capped supply.

ETF Approval: Bitcoin ETFs play a crucial role in increasing demand from institutional investors who previously lacked access. For instance, Blackrock’s (BLK) iShares Bitcoin ETF (IBIT) has already attracted more assets than its iShares Gold ETF (IAU) in just 10 months. Additionally, ETF approval ensures that regulators can’t easily change their stance on Bitcoin.

Institutional Adoption: As more Bitcoin ETFs emerge, they will facilitate greater access for firms following MicroStrategy’s lead, along with institutions like pension funds and nation-states, including El Salvador.

Could a U.S. Bitcoin Strategic Reserve Form?

Recently, Wyoming Republican Senator Cynthia Lummis announced plans for a U.S. Bitcoin Strategic Reserve. Lummis, a known ally of President-Elect Donald Trump, has long supported Bitcoin. Trump’s shift from skepticism to endorsing cryptocurrency was evident when he spoke at a Bitcoin conference this year.

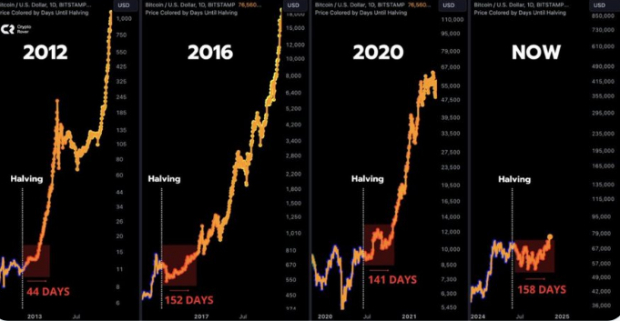

The Bitcoin Halving Effect

Historically, owning Bitcoin has proven most advantageous about 150 days after a “halving” event, which often coincides with presidential elections.

Image Source: Zacks Investment Research

Conclusion

Michael Saylor’s confident stance on Bitcoin is underscored by his significant investments in the asset. His recent interview further clarifies his long-term bullish outlook for Bitcoin.

Discover Promising Clean Energy Stocks

The clean energy sector is burgeoning, with advanced technology set to reshape the industry. Investments in solar power and hydrogen fuel cells are growing rapidly, pointing to a shift away from traditional fossil fuels. This evolution can unveil lucrative opportunities for investors.

Emerging companies in this sector could represent exciting additions to your investment portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

BlackRock, Inc. (BLK) : Free Stock Analysis Report

iShares Gold Trust (IAU): ETF Research Reports

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.